- Fri. Mar 13th, 2026

Latest Post

CONSTITUTIONAL ASYMMETRY, ECONOMIC DEPENDENCY,AND THE CASE FOR NATIONAL SELF-DETERMINATION

Wales, Scotland, and Northern Ireland in Historical,Sociological and Economic Perspective This paper examines the structural, historical, and economic contradictions inherent…

The Necessity of a United Nations HQ Relocation to the Hague with a Permanent Nuremberg Tribunal.The Impunity Crisis of Rogue Governments

The world witnesses today an unprecedented crisis of accountability in international law. As the genocide in Gaza unfolds before global…

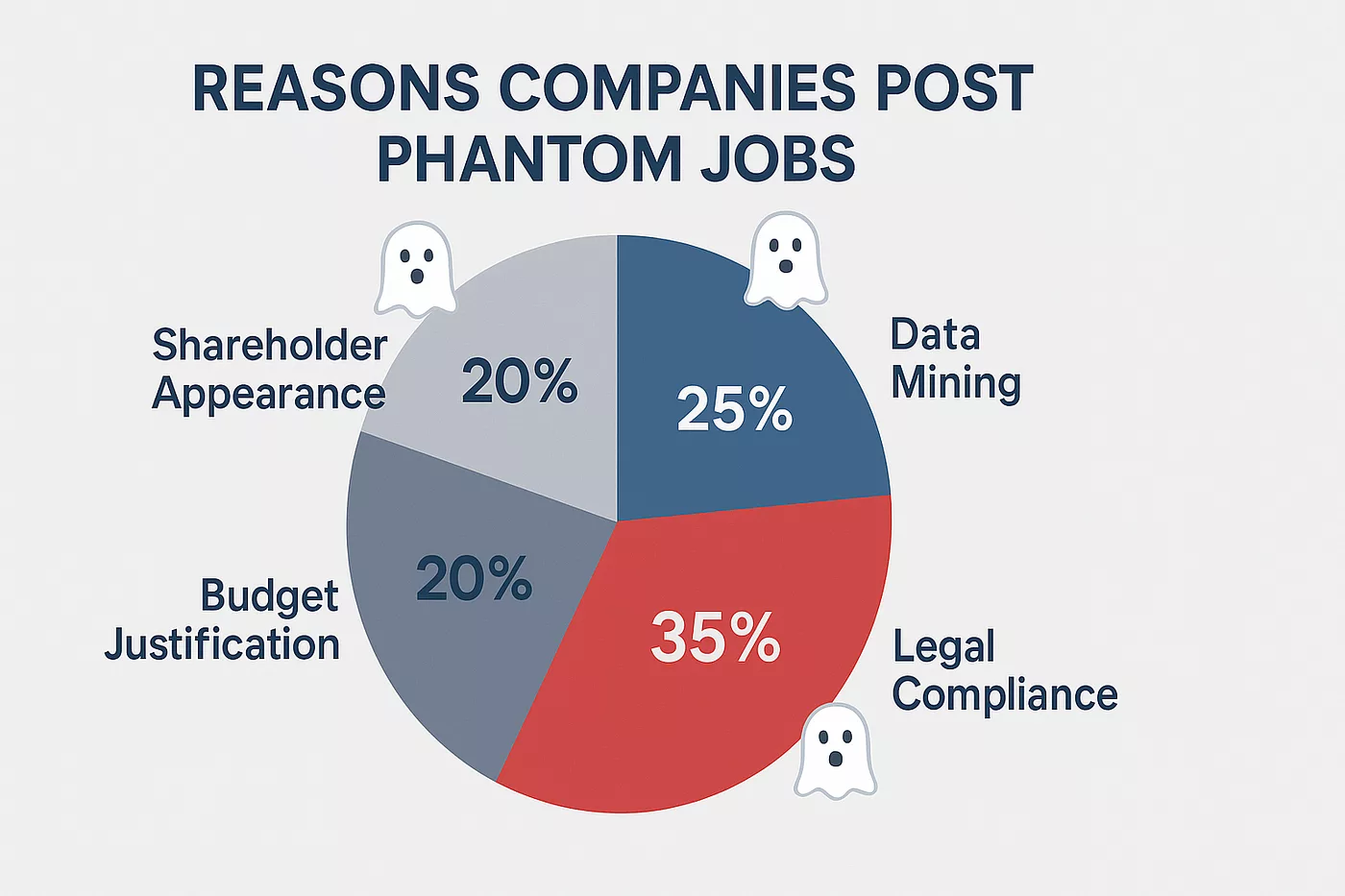

The Digital Job Posting Bubble: Quantifying Phantom Demand in Online Labor Markets

Are businesses and corporates truly hiring ? Has the digital economy become a massive convenience mystification of actual economic activities?…

United States Criminality and Impunity: Historical-Sociological Perspective of United States Unaccountability and Impunity at the behest of International Law

The United States emerged from World War II as a principal architect of the modern international legal order, including the…

What Everyone Gets Wrong About Inflation: 5 Surprising Economic Data

The public is rightly concerned about the rising cost of living, and the dominant economic narrative offers what seem like…

How the Bank of England’s Balancing Act Shapes the UK Economy

When financial markets become volatile and the cost of government borrowing spikes, news headlines often point to political rumors or…

The Sovereign Monetary Covenant: A Blueprint for Post-Debt Prosperity in the United Kingdom

The End of the Debt Imperative, toward a Net Savings Economy We stand at the precipice of a fundamental misunderstanding…

The Dialectical Emergence of Social Movements from Economic Structures

The relationship between material conditions and ideological formations has long been contested in social theory. Idealist traditions, from Hegel through…

China is a danger to democracy

Timeline of classified mass-surveillance operations (Tempora, PRISM, ECHELON, and related) ECHELON — early global SIGINT (Five Eyes) STELLARWIND / post-9/11…

What’s Going on in Equities and ETFs

The current market landscape presents a tale of two extremes. On one hand, a wave of volatility has swept through…

Euro Area Inflation and Growth Shows Resilience

Economic data for the euro area presents a mixed picture, with inflation proving stickier than anticipated while growth remains fragile.…

Overnight Australian Inflation Kangaroo Jump

Australia’s latest inflation data has significantly altered the outlook for the Reserve Bank of Australia (RBA), with a surprise jump…

Global Markets Brief, Gold Plummets

After the record highs in stocks from Tokyo to New York City, global markets show a mixed picture while taking…

The Political Illness of Modern Society: From Totalitarian Tyrannies to the Liquid Society and MultiPolar World Disorder. Politicisation of Society as Mass Psychopathology

From the late nineteenth into the early twentieth century, Western intellectual and political currents witnessed the rise of ideologies that…

What’s Going on with Regional Banks in the U.S.

Several banks, including Zion Bancorp, Western Alliance Bancorp, Citizens Financial Group, KeyCorp, TR Financial, Andidon Bank Shares, Regions Financial, and…

Global Markets Morning Brief

Global markets are navigating a complex landscape shaped by robust corporate earnings, evolving trade policies, and geopolitical tensions. The ongoing…

UK Inflation Outlook: Persistent Inflationary Pressures and the Narrow Path to Price Stability

Recent data from the Office for National Statistics (ONS) indicates that UK inflation has been stubbornly persistent, with the Consumer…

Stocks at 52-Week Highs and Dividend Stock Ideas

In this week stock market movers and shakers, you’d better have an idea about the most important stocks that have…

Overnight Economic Data and Macro-Data of The Week

Your Old China plates’ economy presents a mixed picture for the third quarter, characterised by robust industrial performance and steady…

Albion Economic Outlook: About the UK

Despite modest growth, the UK economy faces a complex landscape. The International Monetary Fund (IMF) predicts the UK will be…

European Stock Market Brief

European markets are showing positive momentum. On the morning of October 15, the pan-European STOXX 600 was up 0.8%, rebounding…

European Inflation: A Diverging Picture Amid Broad Disinflation

The latest batch of European macroeconomic data, culminating in the September figures from France and Spain, confirms that the continent…

Overnight Asia Macro-Data and Markets

Asian session has been characterized by a rebound in equity markets, driven by dovish signals from the U.S. Federal Reserve,…

Stocks On the Move: Quarterly Earnings and 52-weeks High

Investors tracking NYSE stocks this week should monitor the earnings reports from major banks (JPM, GS, WFC, C), essential consumer…

Global Markets Brief: Unemployment rises to 4.8% in the UK

Among Many Economic Data starting the week after a long week-end with celebrating Columbus Day, Macro-Economic data this morning, confirm…

France’s Runaway Budget Deficit: Political and Fiscal Crisis Threatening Economic and Financial Stability

France finds itself trapped in a deepening fiscal crisis that has become inseparable from its ongoing political turmoil. What was…

Asia Overnights Macro Data, Japanese Yen Continues Weakening

The overall tone in Asian markets this morning is shaped by slower Japanese wage growth and weakening corporate sentiment, juxtaposed…

Global Market Morning Brief and Overnights

Global markets had a dynamic against a backdrop of shifting yields, commodity surges, and headline economic releases. This Capital Market…

An Integrated Multi-Methodological Assessment of Global Equity Markets: Navigating the Late-Cycle Transition

The contemporary financial landscape presents a complex tapestry, one that cannot be accurately interpreted through a single analytical lens. To…

ADP Friday Special Report: Clear Signs of a Deteriorating U.S. Jobs Market, with a 4.6% Unemployment Rate Forecast

The ongoing federal government shutdown has plunged investors and policymakers into a critical information vacuum, halting the release of all…

Impact of Technology on the Labor Market and Taxation

The Flattening of the Phillips Curve Alternative Drivers of Inflation Macroeconomic Models and Parameters Central Bank Monetary Policy and Its…

EUROPEAN STOCK MARKET INDEX CORRECTION COMING UP

Limitations of Technical Charts and Importance of Order Flow Understanding Volume Profile (B, D, P) Here is a flowchart illustrating…

ETF Analysis and Gold’s Rally

Major ETF Performance and Correlations Gold’s Hedging Properties Here is a Venn diagram illustrating gold’s multiple hedging roles: Portfolio Optimisation…

Challenges in Modeling Tariff Pass-Through

Here is a flowchart illustrating the direct tariff pass-through effect: Modelling Approaches and Forecasts Sector-Specific Tariff Impacts Monetary Policy Implications…

The Necessity of a United Nations HQ Relocation to the Hague with a Permanent Nuremberg Tribunal.The Impunity Crisis of Rogue Governments

The world witnesses today an unprecedented crisis of accountability in international law. As the genocide in Gaza unfolds before global…

The Necessity of a United Nations HQ Relocation to the Hague with a Permanent Nuremberg Tribunal

The world witnesses today an unprecedented crisis of accountability in international law. As the genocide in Gaza unfolds before global…

The Balfour Declaration and the Two-State Solution: Colonial Legacy, Semantic Ambiguities and the Perpetuation of Palestinians’ Genocide

The relationship between the 1917 Balfour Declaration and the contemporary “two-state solution” represents more than mere historical continuity; it exemplifies…

Anti-European Tropes are Equivalent to Xenophobic, Racist, Anti-Semitic slurs and Considered a Direct Threat to all European Democracies and Citizens

In the contemporary political landscape, Europe faces unprecedented challenges from both internal and external forces that seek to undermine its…

Soviet Genocides in Ukraine and the Baltic Republics: Historical Studies and Evidence

The history of the Soviet Union is marked by numerous instances of state violence and repression, but few events have…

Soviet Terror: Repression and Violence Under Stalin’s Dictatorship

The Soviet Union under Joseph Stalin represented one of the most comprehensive and systematic implementations of state terror in the…

Russia’s Political Organization: Oligarchic Government Structures Under Putin’s Terror

Through examination of historical development, power structures, economic systems, and psychological dynamics, this report reveals how Russia has evolved from…

UltraWealthy Anarchist SBLOCs Risk. Potential Leverage Crisis in Wealth Management Industry and Regulatory Blind Spot in Modern Banking

A critical and largely unaddressed vulnerability exists within the modern financial system: the lack of comprehensive regulatory oversight and transparent…

The United States is not an Accomplished Democracy: A Critical Analysis of the Second Amendment and the Social Contract

The United States presents a paradox in democratic theory: a nation with robust electoral institutions, constitutional protections, and democratic traditions…

La Nécessité Universelle d’une Déclaration Universelle des Droits de l’Homme, Plus Complète et Améliorée

The Universal Declaration of Human Rights, adopted by the United Nations General Assembly on December 10, 1948, stands as one…

The British Empire’s Hidden Legacy: Concentration Camps, Chemical Experiments. What then Became, Eichmann Mass Genocide Machine

This comprehensive report presents overwhelming historical evidence that the British Empire systematically pioneered and developed the technologies, methods, and administrative…

Crisis and Institutional Erosion: The Contemporary Britain a mirror of Weimer Republic

The historical comparison between the Weimar Republic and contemporary Britain reveals concerning structural parallels in how democratic systems can deteriorate…

The Architecture of Human Flourishing: Aristotle’s Nicomachean Ethics

Aristotle’s Nicomachean Ethics stands as one of the most influential and enduring works in the history of moral philosophy. Written…

Legal Framework for Asylum Seekers Repatriation: UK, France, and EU Options Under International Law

The movement of asylum seekers from France to the UK presents complex legal challenges under international refugee law. Withstanding the…

British Colonial Exploitation and Crimes Against Humanity: A Historical Analysis

The British Empire, at its zenith, spanning approximately one-quarter of the world’s landmass and population, represents one of history’s most…

UK Constitutional Crisis. Potential Consequences of ECHR “Withdrawal” and the Crime Against Humanity of Mass Deportation Policies

The polemic advanced by Reform UK, including mass deportations and withdrawal from the European Convention on Human Rights (ECHR), represents…

Constitutional Necessity of an Irish Unity Referendum in the Near Future For Ireland Stability

The United Kingdom’s withdrawal from the European Convention on Human Rights would precipitate an unprecedented constitutional crisis that could trigger…

Privatized Asylum Industry: Corporate Profits, Political Connections, and Exploitation Concerns. Serco the Manure of Evil

The UK’s asylum accommodation system has been transformed into a highly profitable private industry worth billions of pounds annually. The…

How Britain’s Tax Haven Network Helps WarLords Money Laundering, while Asylum Seekers are made scapegoats

In one of history’s most striking constitutional ironies, the same legal frameworks that have enabled Britain’s overseas territories and Crown…

The “Special Relationship” and the hefty cost of a potential IMF Debt Restructuring. UK Brexit mistakes and the Inflation Linked Gilt Market Achilles Heel

The United Kingdom could be staring toward the precipice of a financial crisis in the future, which eerily echoes the…

The Moral Catastrophe of Global Food Waste while Innocent Human Beings in GAZA are Starved to Famine

The contemporary world presents a paradox so stark and morally reprehensible that it defies rational explanation: while millions face hunger…

The Betrayal of Jewish Historical Values. Netanyahu’s Extremist Government and the Desecration of Holocaust Memory

The ongoing policies of Benjamin Netanyahu’s government represent one of the most profound betrayals in Jewish history—a systematic abandonment of…

Semitic Languages and the Israeli-Palestinian Conflict: Linguistic Heritage and Human Tragedy

The Semitic linguistic heritage of both civilisations points to shared cultural and historical foundations, while the ongoing conflict in Israel-Palestine…

Promise of Democratic Governance and Open Economy Transformation. Iran’s Natural and Economic Resources

Iran stands as one of the world’s most resource-rich nations, possessing vast reserves of hydrocarbons and strategic minerals that position…

THE AYATOLLAH REGIME WON’T BE ABLE TO STAND. THE REGIME HAS VIOLATED THE JCPOA AND IT HAS BEEN OPENLY LYING TO THE PRESS AND THE INTERNATIONAL COMMUNITY

Iran’s growing network of missile silos, hardened underground tunnels, and layered air defense systems are a challenge that will be…

Stabilization Through Peacekeeping: The Strategic Role of a Joint Task Force in the Persian Gulf

The Islamic Republic of Iran stands at a critical juncture in 2025. Iranian authorities have continued to repress peaceful dissent…

IRAN INSTABILITY REQUIRES AYATOLLAH REGIME TO TAKE SAFE CORRIDOR OFFER FROM RUSSIA

The Persian Gulf area has long been a volatile region, and the ongoing instability in Iran underscores a Middle East…

RESOURCES AND MATERIAL LIMITS TO TECHNOLOGICAL GROWTH

Heraclitus famously asserted that ἀνάγκη (necessity) is the natural force shaping human life, the world and the kosmos. In contrast,…

Iran Regime Repression against Rising Resistance asking global community for Regime Change

Iran continues to face mounting internal pressure as widespread protests, economic hardship, and systematic government repression create a volatile situation…

Middle East Geopolitical Dynamics and Regional Power Structures, why the US aims at reinstating the Shah Regime in Iran

Iran’s Challenges and Economic Pressures Iran faces unprecedented economic and social pressures that have significantly impacted its domestic stability. On…

The Historical Necessity of a renewed Workers’ International for the Future of Humanity, against the Militarized Oligarchic Neoliberalist Regime

The Workers’ International, Russian Revolution, and the Transformation of European Socialism. The Foundational Pillars of Socialist Transformation The Workers’ International…

Russia Could Deploy Military Assets in Cuba Again

The longstanding alliance between Cuba and Russia could have experienced a significant resurgence since 2022, marked by increasingly close diplomatic…

The Architecture of Exploitation: United States Immigration Policy and Systematic Modern Slavery

This comprehensive report presents evidence that the United States has systematically created and maintained conditions constituting modern slavery through coordinated…

America’s a Rebel Nation

The United States faces an unprecedented constitutional crisis as a series of executive orders have been issued that fundamentally challenge…

Ukraine’s Historical Foundations and the Right to Self-Determination and to be part of the European Union

The question of Ukraine’s sovereignty and its right to choose its international partnerships represents one of the most significant geopolitical…

UNITED STATES GOVERNMENT VIOLATIONS OF HABEAS CORPUS ARE A VIOLATION OF ARTICLE 3 OF THE NATO TREATY AND A THREAT TO INTERNATIONAL LAW

THE UNITED STATES OF AMERICA WILL BE OFFICIALLY DEFINED: ROGUE STATE IN THE FORM OF ETHNO-NATIONALIST, NAZIST, WHITE SUPREMATIST, GENOCIDAL…

Osint Report of Far-Right Neo-Facist Neo-Nazist Extremist Organizations in Europe and the United States

Osint Report // This report provides a summary of far-right, ultranationalist, neo-fascist, and neo-Nazi groups across the United States and…

UBI Stablecoin Implementation: Theoretical-Pillar Funding Model and Digital €uro Operational Structures

System Architecture Framework Three-Pillar Funding Model Operational Framework Structure,Multi-Level Governance Architecture Technical Infrastructure Layers Economic Flow Models, Circular Flow with…

Dark Pools: Hidden Markets and Their Impact on Financial Stability

How many times any ordinary investor would have heard this phrase from the Investment Bank Advisor : ” you need…

Liquidity Illusion: Systemic Risk, Securitization, and the Shadow Banking Leverage. Quantitative Analysis (1Q-2025)

This comprehensive analysis examines the paradoxical relationship between apparent market liquidity and underlying systemic risk in the U.S. financial system…

Structural Fragility of the U.S. Financial System

The United States’ financial system exhibits profound structural idiosyncratic disequilibria that challenge ordinary assessments of economic stability. Through a comprehensive…

Britain’s Criminal Media Industry: Foreign-Owned Networks and the Global Disinformation Apparatus

Britain’s media landscape has been transformed into a sophisticated disinformation apparatus controlled by foreign corporate entities that systematically promote far-right…

Why the Coalition of the Willing Is a Strategic Disequilibria Mistake: the Case for a Cold Peace in Ukraine

In the complicated and multi-faceted Rubik’s cube conflict scenario surrounding Russia’s invasion of Ukraine, the potential outcomes of strategic interaction…

Britain’s Racism, Xenophobia, Breach of International Treaties, Violations of Civil Rights and the Criminal Hostility Towards Europe and its Citizens

In the years leading up to and following the Brexit referendum, a troubling undercurrent of racism and xenophobia against European…

Post-Fascism and Neo-Fascist in Italy: Legal Violations, Political Complicity, and the Erosion of Democratic Guarantees

More than eight decades after the fall of the Fascist Dictator Mussolini, Italy continues to grapple with the spectre of…

Europe has forgotten its primary objective, being a multilateral economic operator in order to preserve peace and stability

The European Economic Area (EEA), originally conceived to deepen economic integration among European nations, must now evolve into a dynamic…

Britain redraws the Curzon Line. How and why the UK,Ukraine and Russia have been global problem nations in the past decade

The Curzon Line, proposed in 1919, was a demarcation line suggested by British Foreign Secretary Lord George Curzon to define…

PALANTIR STOCK VOLATILITY: A CANARY IN THE COAL MINE FOR TECH STOCK BUBBLE AND MARKET CORRECTION ?

Palantir Technologies (PLTR) has been one of the most volatile stocks in the technology sector, with its valuation soaring amid…

Q1 2025 Seasonal Volatility and Stock Market Correction: A Forecasting Analysis

The first quarter of 2025 may bring increased stock market volatility, potentially leading to a market correction. A detailed analysis…

TECH STOCKS BUBBLE RISK: MARKET INSIGHTS

https://www.youtube.com/watch?v=GIB2koKnN8A

What Sparks a -20% Dollar Crash? Analyzing Risks, Scenarios, and Market Reactions!

https://www.youtube.com/watch?v=4K2JOn9sx4U&t=1s

ALL YOU NEED TO KNOW ABOUT UK BOND MARKET VOLATILITY AND SPIRALLING HIGHER YIELDS RISK

https://www.youtube.com/watch?v=d0sBry1fLOk

What to expect from UK Retail Sales data off the Christmas period

https://www.youtube.com/watch?v=g5Jj_UzAlFs

Forced Labor in Cobalt Mining in the Democratic Republic of the Congo ( United States Department of Labor, Final Report)

HOW CRITICAL MINERAL RESOURCES ARE EXTRACTED IN THE DEMOCRATIC REPUBLIC OF CONGO, FROM UNSAFE COBALT MINES, BY FORCED LABOR AND…

Leverage effect could bring seasonal Q1 stock market drawdown

The recent Q4 volatility patterns of the major U.S stock market Index, such as Dow Jones Industrial Average, S&P500, Nasdaq100…

FORECASTING EQUITY INDEX VOLATILITY: EMPIRICAL EVIDENCE FROM JAPAN,UK AND USA DATA

Understanding and forecasting equity market volatility has become an essential focus for financial analysts, policymakers, and academic researchers. In this…

Forecasting Volatility in Asianand European Stock Marketswith Asymmetric GARCHModels

The dynamics of financial market volatility have long captured the interest of researchers and practitioners alike, particularly due to its…

Dynamic Interactions Between Macroeconomic Variables: Evidence from VAR Forecasting Models

In this article the readers can find theoretical econometric research about the dynamic relationships between macroeconomic indicators, including inflation, interest…

How Many Millions of Human Lives Have Been Sacrified for the Surge of Global Stock Markets?

The Green Ride of the Stock Market: A Modern-Day Green Horseman of the Apocalypse The exponential rise of the stock…

The many reasons why the British Pound can depreciate below parity against the USDollar

When considering the simple data of United States GDP of $27.3 Trillion Dollars in aggregate compare and contrast with United…

Affordable EVs: The Role of Sodium-Ion Batteries in Reducing Car Production Costs

In 2023, the European Union (EU) produced approximately 12.1 million passenger cars, marking an 11.3% increase from the previous year.…

Government Wage Shocks: A Fiscal Trap with Long-Term Consequences

The question of how governments should deploy fiscal tools to stimulate economic growth or address crises has long been debated.…

Econometrics research of CPIH Volatility Inference with Interest Rate Volatility

The British economy, as well as many other developed economies, has structural inflation issues that are not correlated to wages,…

The many good reasons for the European Union to propose the UK joining back Europe

The United Kingdom’s withdrawal from the European Union (EU) has proven to be one of the most consequential political and…

Private Sector Social Contributions Shocks and lagged macro-economy effects

Shocks affecting disposable income of households, Three fiscal shocks crucially affect the disposable income of households. These shocks are associated…

Unmasking the Far-Right Fascism: How the European Union Covers Authoritarianism and Human Rights Abuses Across Europe

The European Union (EU), founded on the principles of democracy, human rights, and the rule of law, has long been…

Consumerism and Commodification of Human Beings, what Gunther Anders taught us with his work “The Obsolescence of Mankind”

“Indem wir lernen, die Dinge zu benutzen und wegzuwerfen, lernen wir, Menschen ebenso zu behandeln.” “By learning to use and…

FTSEMIB timeseries volatility study and -26% volatility risk scenario

An extensive time-series analysis has been carried over the FTSEMIB to gather statistical parameters and analyse the FTSEMIB daily and…

Why NewsCorp shares are overvalued

A Media Conglomerate of Global Disinformation and illegal unethical practices, with a weak balance sheet and shrinking operating margins, is…

Tokamak: the Holy Grail of Energy

Nuclear fusion, the process that powers the Sun, has long been considered the “holy grail” of energy production due to…

UK GILT yield curve at risk of sustained higher volatility

From a technical standpoint, the bond market reaction function to the Autumn Budget 2024 has been similar to the mini-budget…

Keep Borrowing and eventually, Britain’s Debt Black Hole will become bigger

The nature of Black Holes in astrophysics and quantum mechanics is still a mystery and an area of intense research…

The Bank for International Settlements (BIS), and the Third Reich Regime’s Financial Offshore money laundering

During the prelude to and the progression of World War II, the German Third Reich was supported by a network…

NASDAQ Halloween Scare and volatility pumpkin spike

As October rolls to its end, markets have their own way of embracing the Halloween spirit, and it seems the…

What’s inside a Gladstone bag ? Fiscal tool to generate Tax Revenue gains from Green logistics supply-chain multiplier effect

The Gladstone bag is a type of large, rigid-sided travel bag or suitcase, typically made of leather or fabric, with…

Back to the Future of Sodium-Ion Energy Storage and Automotive mobility

“Sine Sale, non est Vita”. Sea salt has a long centenary history as a valuable commodity, used at first as…

What could potentially change in United States foreign policy with a Trump Presidency

A potential Donald Trump presidency could mark a significant shift in U.S. foreign policy and geopolitics, with a focus on…

“Deppenapostroph”, Anglicism in commercial Deutsche, and what already said Heidegger in 1957 about language

Deppenapostroph ist das Gegenteil von denkender Sprache

7th October 1985, the Achille Lauro Hijacking by the PLF and what later became the Sigonella standoff

On October 7, 1985, the Italian cruise ship Achille Lauro was hijacked by four members of the Palestinian Liberation Front…

Britain’s path to Long-Term Economic Decline and Stagnation

In recent years, the socio-political landscape in Great Britain has undergone significant changes. Rising economic uncertainty, social division, and the…

The thin horizon line at the boundaries of the Tragic Nature of Human Existence

From the earliest days of human thought, philosophers have wrestled with the fundamental questions of existence: What does it mean…

American Corporations Are Buying Up Britain–It’s Very Bad for Ordinary British People

The growing dominance of American corporations in the UK presents challenges, particularly for workers, consumers, and smaller businesses. While foreign…

Overview forecast of a 40-50% Market Cap Decline in MAG7 Stocks on the US Economy. Implications of declining saving rates

The "Magnificent Seven" (Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla) have a combined market capitalization of approximately $15.76 trillion(Stock…

Understanding Stock Splits: Their Mechanics and the risks to Financial Stability and the Economy

Stock splits are a common corporate action wherein a company increases the number of its shares while proportionally reducing the…

Private Companies as Political Entities and Foundations, the risk of Ponzi Schemes and Political Fraud

A more complex and under-examined example of Ponzi schemes can be found within private political foundations and political parties registered…

Lebanon’s struggle to implement the Taif Agreement and the resistance movements against Hezbollah

Lebanon's social and economic struggle and instability have been a feature of the country for some decades, and the Beirut…

Reformism as Demagoguery in a Partitocracy: The Masking of Corruption and Undemocratic Authoritarianism

Reformism, when manipulated by a corrupt political system, becomes a demagogic tool used to deceive the public and maintain power.…

How to promote lasting Peace Treaty in the Russia Ukraine conflict and wider security agreements between NATO and Russia. Prospects of wider Geopolitical and economic stability.

The conflict between Ukraine and Russia has engendered significant human suffering, geopolitical instability, and economic disruption, not only within the…

The Necessity of Investigations and Actions to Combat Anti-Europeanism and Unmask Antisemitic Conspiratorial Tendencies

To effectively address anti-Europeanism and its hidden conspiratorial tendencies—particularly those that carry antisemitic undertones—it is essential to focus on investigations,…

The Uncanny Truth About Anti-Europeanism as a Form of Covert Antisemitism: Historical and Ideological Perspective

Anti-Europeanism, especially when framed as opposition to the European Union and broader European integration, has emerged as a political and…

The Ideological Parallels Between Nigel Farage and Hitler: Xenophobia, Racism, and AntiEuropeanism as AntiSemitism

The rise of nationalist and populist rhetoric in Europe, particularly in the context of Brexit, has drawn historical comparisons to…

The Current State of Hedge Funds’ Leverage and Implications for Big Banks

Hedge funds, known for their aggressive and often highly speculative investment strategies, have leveraged their portfolios to extraordinary levels in…

History of Soviet Union dangers posed to Europe through KGB operations

The Soviet Union, from its inception in 1922 until its dissolution in 1991, represented one of the most formidable threats…

Arabs’ money and the human trafficking business

In recent years, the influx of money from Arab autocracies into Europe has been substantial, spanning various sectors such as…

The opaque dynamics of plunder, Exploitation, Corruption, and Money Laundering

Globalization, driven by opaque unregulated illegal capitalist imperatives, has transformed the global economy into a complex network of financial flows,…

The Ideological Propaganda of Brexit: Spreading Racism, Xenophobia, and Populism in Europe and Its Unintended Consequences for Ukraine

Brexit, the United Kingdom’s departure from the European Union, has been often viewed through the lens of national sovereignty and…

EUR/USD adjusts for Interest Rate Differential Amid Anticipated ECB Rate Cut

The Euribor rates term structure currently discounts 65 basis points from the European Central Bank’s interest rate, which stands at…

Bund Yield Curve Steepening: Term Premium to Rise in Longer Durations

Bund’s Yield Curve Term premium to steepen in longer duration Germany’s prevailing uncertainties and projected macroeconomic landscape will necessitate a…

The Multi-Decades anti-socialism and anti-CP propaganda in Europe implemented by the United States, a peculiar interpretation of Democracy

The United States, Churchill, and the Shadow of Operation Paperclip: Controversies in 1945 In the summer of 1945, as World…

John Stuart Mill, “On liberty of thought and Discussion”

John Stuart Mill’s seminal work, On Liberty, published in 1859, remains one of the most influential philosophical texts on the…

McIntyre’s Contrapposition between Aristotelian ethics and Hobbes’ individualism

During the 1980s an absolutely decisive text was published by McIntyre who rightly or wrongly is considered to be one…

4-Week Average Jobless Claims increase to 240000, expect higher Unemployment

United States 4-week average jobless claims have increased to 240,000 from the previous 238,000, indicating that the U.S. economy is…

Japan’s debt leverage has been increasing to worrying levels, what could be the implications for the Japanese Yen

Although a very resilient and highly productive and highly technological economy, Japan has achieved many milestones with consistent and somewhat…

United States Household Debt Balance breaks another record, setting American Households $17.8 Trillion in the red, while Credit Card delinquency rates are on the rise

Total consumer debt in the United States has reached an unprecedented level, with American households now owing a staggering $17.8…

Ireland’s economy in a prolonged recession sees the Unemployment rate rising to 4.7%

Ireland has experienced a recession starting from the first quarter of 2023 and continuing through the second quarter of 2024…

On the Origins of Totalitarianism, Hanna Arendt described the ideological role of Englishmen’s Racism

Hannah Arendt’s seminal work, “The Origins of Totalitarianism,” published in 1951, delves into the complex and multifaceted nature of totalitarian…

Founded out of the Drugs and Opium Trade in Hong Kong, how HSBC operated since then, scandal after money laundering scandal

HSBC, one of the world’s largest and most influential banks, has a history shrouded in controversy. Founded in Hong Kong…

Sweden’s OMSX30 market correction of equities mispricing seems almost inevitable as a hot summer meltdown

Sweden’s economic data confirm early warnings of a Housing Market Debt burst feeding into Economic Recession and Unemployment. Latest data…

Earth and Water. Ocean Fluids Dynamics, Tidal Forces, and Water in empty Space

The dynamics of water, from the vast ocean currents and tidal forces that shape our planet to its behavior in…

Dollar Overnight Money Market interest rate rise to 5.4%

The SOFR rates (Secured Overnight Financing Rate) a direct interest rate function of the Federal Reserve money market system increased…

Italian Government -8.8% Q1 fiscal deficit seems way out of order

The quarterly non-financial sector account summary of Italy’s General Government account gives a brief concise framework of Italy’s public finances…

Extracting Market Performance and Volatility Patterns of Blue-Chip Stocks and the FTSE100 Index

Samples of FTSE100 blue chip stocks and the FTSE100 index have been elaborated to understand the stocks’ returns and the…

The USA Unemployment rate drifting toward non-cyclical rate of unemployment hints at a possible Recession scenario going forward

OBSERVING CORE INFLATION, UNEMPLOYMENT RATE AND NON-CYCLICAL RATE OF UNEMPLOYMENT, VERY SIMPLE GRAPHS EXPLAIN A LOT. EVERY TIME THE UNEMPLOYMENT…

EUR/USD 1.068 exchange rate will probably become more volatile, with EUR/USD parity

The Euro could be set to become much more volatile in the FX market, considering the interest rates differential with…

Econometrics forecast research about USA macroeconomic timeseries

In the quest for clues about how the global economy could perform in the coming quarters, additional econometrics research has…

MAJOR POUND STERLING EXCHANGE RATES VOLATILITY STUDY

GBP/CHF, GBP/JPY AND GBP/USD GRAPHS OF HISTORICAL VOLATILITY CALCULATED WITH 30 DAYS STDV OF LOG RETURNS, THEN 3-MONTH, 6-MONTH AND…

How the USA economy could perform in the coming quarters ?

Latest Q1 data from the USA economy have seen a decrease in the rate of GDP expansion in Q1 correlated…

Russians bought up $6.3 billion in Dubai property after 2022 Ukraine invasion, report finds

Since the 2022 invasion of Ukraine, Russian nationals have bought up $6.3 billion in existing and in-development properties in Dubai,…

Moody’s downgrades Mobico’s rating to Baa3; downgrades the company’s £1.5 billion backed senior unsecured medium term note (MTN) programme to (P)Baa3 from (P)Baa2, its £250 million backed senior unsecured medium term notes due 2028

Moody’s Ratings (Moody’s) has today downgraded Mobico Group PLC’s (Mobico) long-term issuer rating to Baa3 from Baa2. At the same…

Federal Fund Effective Rate Comparative (ATSM) Analysis of Interest Rate Forecast

CIR interest rate forecast model Cox Ingersoll Ross model to forecast interest rate variables in simple terms defines an Effective…

Sweden Q1 -1.1% economic growth figures confirm recession for four quarters in a row

Latest Swedish GDP figures confirm a recessionary trend that has been accelerating in momentum, with a -1.1% Q1 economic growth…

Comcast overpriced acquisition of Sky plc implied devastating effects on Comcast debt leverage. Soon the corporate could seek for potential buyers to offload Sky plc

Comcast balance sheet has been poisoned with the acquisition of the British Broadcast Sky Plc, that has brought additional leverage…

When Ireland can agree to a unification referendum with Northern Ireland, according to the Good Friday Agreement

The 1998 Good Friday Agreement explicitly envisages a possible referendum on the creation of a United Ireland. A significant section…

Economic investments and economic growth are distinct from stock speculation

https://www.youtube.com/watch?v=p40L8GkcT1g

Investments in the Economy amount to tangible output production. Speculative stocks are not

Would be useful to actually make a material distinction between investments and speculative investments. INVESTMENTS IN THE ECONOMY ARE MADE…

Estimating volatility of Inflation metrics, implementing MSE volatility, ARCH GARCH HS comparison

Study of Inflation metrics volatility has been started with estimating the 3/6/9/12 months volatility extracted form Mean Squared Error in…

Love and Unity: Aristophanes’ Myth of Eros in Plato’s Symposium

Aristophanes manages to relieve himself of hiccups by applying a remedy – sneezing stimulation – suggested by Erissimachus, whose name,…

Navigating Credit Spreads: Understanding Yield Curve Volatility and Fiscal Deficit Risks

https://www.youtube.com/watch?v=kLKLaY2hotU

The Price Surge: How Commodities, Energy, and Deficits Fuel Inflation (and What You Can Do About It)

https://www.youtube.com/watch?v=APmqaMR3UV4

Navigating the Risks of Speculative Bubbles of the Magnificent Seven

https://www.youtube.com/watch?v=-W1rqJAt9AM

Money Market: How it Works and Why You Should Care

https://www.youtube.com/watch?v=dpjZ6hvR9gg

A.I. STOCK MARKET BUBBLE ?

https://www.youtube.com/watch?v=NcnGrEZvso0

Financial Derivatives and Their Risks for Financial and Economic Stability

Financial derivatives have revolutionized modern finance by providing tools for risk management, speculation, and investment. However, their widespread use also…

Basel III: A globalregulatory framework formore resilient banks andbanking systems

BASEL III: Strengthening the Backbone of the Global Financial System The world of finance is an ever-evolving landscape, shaped by…

Forecasting Value-at-Risk under Fat-Tail Distribution Assumptions

Financial Econometrics studies have demonstrated that forecasting Value At Risk under standard normal distribution conditions could lead to underestimation of…

Higher Prices for Longer, you’re all screwed up, unless you’ll embrace unemployment

John Maynard Keynes theorized and explained the necessity of aggregate supply/demand equilibrium, the Fed messed it all up and now…

Capitalism as an economic and social science can’t be imposed as a dogma. Humanity has to achieve better than consumerism

When we observe the Universe, becomes evident the insignificant meaning of planet Earth in the Milky Way, and the insignificant…

Unveiling the Complex Tapestry of Stock Market Crashes: A Comprehensive Exploration

The history of financial markets is punctuated by episodes of euphoria and despair, with stock market crashes serving as ominous…

Muslim Theocratic Regimes are out of history, out of time, and incompatible with the free world based on the Greek-Roman Civilization

Like Strauss in his famous book “Das Leben Jesu”, The Life of Jesus, treats the idea of God and the…

BUOYANT NIKKEI 225 FUTURES BREAK OUT OVERNIGHT WITH INFLOWS IN JAPANESE EQUITIES

Japanese equities continue to attract inflows, the Nikkei225 ‘Mar Futures contract had a very positive session with a 2.32% breakout…

10y Treasuries and 10y BTP could be at risk of a brutal force sell-off, on Fiscal deficit worries

Treasuries futures chart Ultra 10-Year Treasuries chart signals a downtrend and drifts lower in the price of the Bond. There…

From Communism to Consumerism. Massification and commodification of mankind

“Capitalism has survived communism. Now, it eats away at itself.” Charles Bukowski Humanity has been forced to live in a…

Social Media dystopian artificial world and the denaturalization of mankind

Technology, social media and propaganda made with the mass media pose an epochal paradox that erodes the foundations of logical…

UK Treasury’s at risk of GILTs funding crisis with loss of access to Sovereign Debt Market

UK-denominated Sovereign Debt GILTs could be at risk of not finding bidders and not finding a price for GILTs debt,…

Karl Jaspers on The Encompassing (1949)

Welcome to our exploration of Karl Jaspers’ profound philosophical insights. In this video, we delve into Jaspers’ seminal work, “The…

On Being and Time

Incredibly interesting how Heidegger in “Being and Time” describes the features of research and theoretical research “Posing a problem means…

“Make me a hinge”. Produce in the most efficient way, in the shortest time, with essential utilization of material.

It’s perhaps shocking to write but fulfilling to admit in inspiration and with an urge of human conscience, the modern…

On Capitalism and Totalitarian thought

We live in a society of waste and consumerism, but no one has the courage to admit it, because the…

On being and existence, according to Karl Jaspers

The existence of being, for Karl Jaspers, is a checkmate of the being and a shipwreck in the impossibility of…

Illiteracy resulting from social media and mass media

Technology, social media and propaganda made with the mass media pose an epochal paradox that erodes the foundations of logical…

Housing market and construction industry could be on a cliff edge in Germany

German House Price Index seems to have peaked after a parabolic multi-decade 0% interest rate Housing market and construction sector…

Where to find the literary references of, Chairman Powell, Symposium speech

The annual Jackson Hole Symposium has been anticipated, followed and commented on with much attention in the financial services industry,…

THE NIFTY50 INDEX IT’S GOING TO TOP OUT WITH A -12% EQUITIES MARKET SELL-OFF

THE CHART OF THE NIFTY50 INDEX COULD BE GOING TO SEE A SHARP FALL DOWNWARD TOPPING OUT, CONSIDERING ALSO THE…

THE FTSE100 COULD BE ON THE VERGE OF AN EQUITIES MARKET CORRECTION

The FTSE 100 chart on a monthly time scale has seen the Bollinger Band giving to the FTSE 100 price…

From the book, Obsolescence of Mankind, Gunther Anders, 1956

“To crush any revolt in advance, one must not use violence. Methods such as those used by Hitler are outdated.…

FRONT END GILTs YIELD CURVE MISPRICED COMPARED TO 5.2% INFLATION EXPECTATIONS

Inflation Expectations in the United Kingdom decreased to 5.20% in April from 5.40% in March of 2023 THE FRONT END…

The S&P 500 is overvalued and a correction would be natural

A macroeconomic interpretation of the Federal Reserve shrinking its balance sheet could be that q(t)=1+C'{I(t)}, the value of one more…

Moody’s downgrades Checkers PDR to Ca-PD/LD following missed principal payment on first-lien term loan facilities

Moody’s downgraded Checkers Holdings, Inc.’s (Checkers) probability of default rating (PDR) to Ca, its corporate family rating (CFR) to Ca…

Moody’s downgrades Checkers Holdings credit rating to Ca following missed principal payment on first-lien term loan facilities

Moody’s downgraded Checkers Holdings, Inc.’s (Checkers) probability of default rating (PDR) to Ca, its corporate family rating (CFR) to Ca…

Moody’s downgrades Provident Group to Caa3 following payment default

Approximately $36 million of debt securities affected Moody’s has downgraded to Caa3 from Caa2 the ratings assigned to Provident Group…

CMBS STRUCTURED FINANCE DEBT ISSUED BY JPMCC DOWNGRADED

Approximately $309 million of structured securities affected downgraded the ratings on two classes of CMBS securities, issued by J.P. Morgan…

Economies with persistent large deficits financed by borrowing, become prone to sustained higher inflation

Economies with persistent large deficits financed by borrowing, become prone to sustained higher inflation. When deficits become too large eventually…

“Poverty, by America”

https://www.youtube.com/watch?v=n5v-DmXUvcM

Sterling money market rates pricing a 5% bank rate peak at the Bank of England

The 3-Month (Sterling Overnight Index Average) interest rate curve forecast a 5% money market peak interest rate according to the…

The 1929 Crisis: Wall Street’s Darkest Hour – A BBC Historical Investigation

https://www.youtube.com/watch?v=YpvbAB9ecJE

The Billion Dollar Scam – BBC World Service

https://www.youtube.com/watch?v=w6JXZ3GzSCQ

Commercial Property Prices decreased by -15% since property prices peaked a year ago

Commercial Property Price Index decreased by 0.2% in March. The index has fallen by -15% since property prices peaked a…

Housing Market prices inflating to unhealthy excesses for credit markets

The housing market has probably increased to risky levels for credit markets. Since 2009, from the lowest average price to…

Treasuries yield curve correlated to CPI Inflation expectations

February CPI (excluding food & energy) year on year was 6.1%, and in Feb 2021 was 1.3%. that makes the…

EURO AREA HICP INFLATION DATA BENEFITS FROM DECREASING ENERGY PRICES

Euro Area Inflation data are quite controversial. CORE CPI jumps to 1.2% an increase of 0.4% from the previous month,…

What do we do with a drunken sailor?

On this chart, UK Inflation Expectations stand at 6.1% On this chart, UK Inflation Expectations have risen to 5.6% in…

UK INFLATION RISES TO 10.4% WITH FOOD INFLATION SURGING TO 18%

As expected the UK CPI Inflation measure increases to 10.4%. This will make sure that the OBR and Exchequer 2.9%…

UK SPRING BUDGET, ANOTHER MISSED OPPORTUNITY

The big idea coming from the UK Exchequer Spring Budget, it’s a rough measure of Capex that won’t produce what’s…

How will drift the USD/JPY exchange rate? More Dollar strength shouldn’t be ignored

Dollar/Yen chart 12 months timeframe. Every candlestick= 12 months. USD/JPY 105.95 | 106.0 exchange rate has seen the largest volume…

S&P 500 POTENTIAL -15% SELL-OFF

SPX price/volume, Daily timescale chart, below the 200-day Exponential Moving Average, that means SPX in logarithmic function. Most important SPX…

France and Italy’s short-term sovereign debt seeing higher volatility

Observing high volatility in the 1-Month CTZ Italian debt yield. There’s a 348 basis point increase intraday. the yield jumped…

Manufacturing Broken Britain. The deceitful role of the MassMedia industry and the political lobbies

The United Kingdom has been on a turbulent political trajectory since the 2016 Brexit referendum. Once heralded as a beacon…