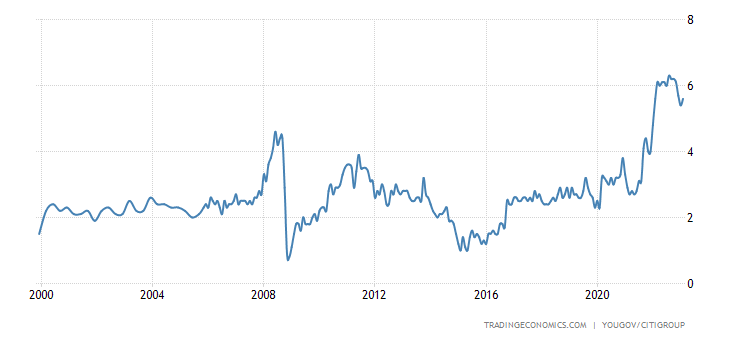

On this chart, UK Inflation Expectations stand at 6.1%

On this chart, UK Inflation Expectations have risen to 5.6% in February, as CPI Inflation increased to 10.4%. Important to notice in the chart, that Inflation Expectations are at the highest point estimation of the past 25 years’ time series.

What do we do with a drunken sailor?

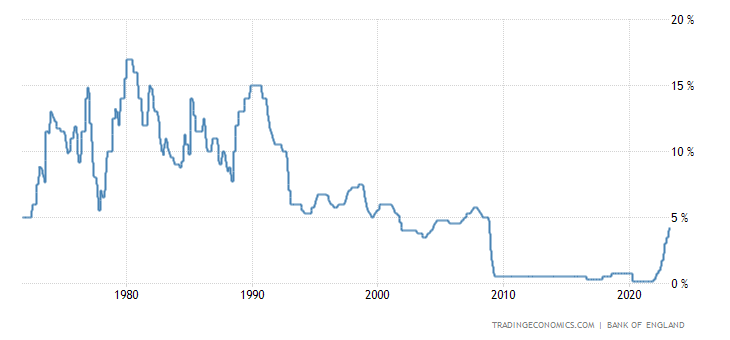

while inflation expectations were at 4.0% already in Q4 2021, double the price stability target of 2.0% and unanchoring probability rising, the BoE kept the bank rate at 0%, only in late Q2 2022 a timid rate hike, but The Boat already Sailed off.

If Inflation and Inflation expectations continue to trend above the Bank of England interest rate benchmark, that will put the Bank in a very interesting and complicated monetary policy position, because to achieve the 2.0% price stability aim, the Bank of England needs to have the Interest rate benchmark in a range of 50 to 100 basis points 0.5%<1.0% above Inflation expectations, in order to see decreasing inflationary effects in the economy. Otherwise, the Bank of England will have to press on with its Balance Sheet shrinking, either by holding to maturity GILTs, also by selling outright GILTs in the open market; that would inject collateral back into the market, while decreasing the aggregate money supply.

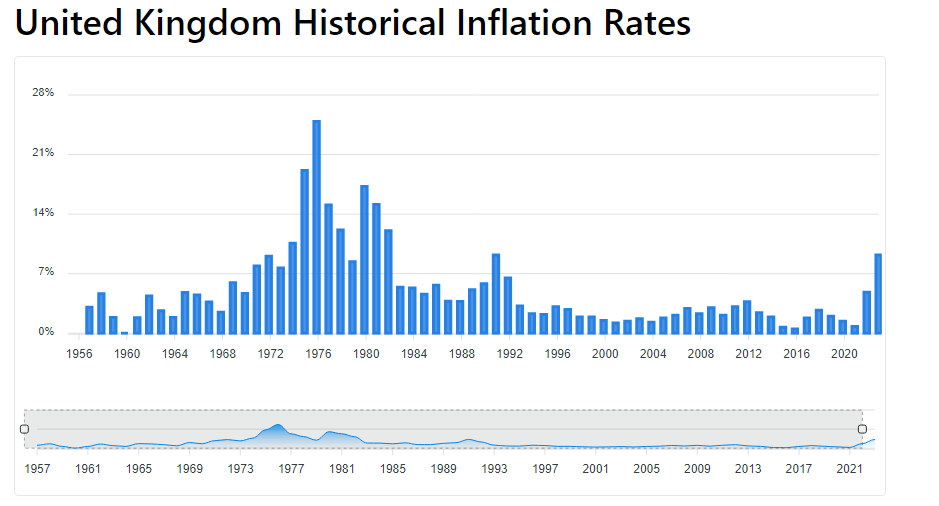

Wider Context of previous Inflationary Shocks, Stagflationary business cycles

CPI Inflation took a bit more than 20 years to stabilise back down to 2.0% average. Aggregate supply shocks such as the energy shock and other supply constraints determined a Stagflationary/ Inflationary economic cycle from 1970 to 1992.