Japan’s debt leverage has been increasing to worrying levels, what could be the implications for the Japanese Yen

Although a very resilient and highly productive and highly technological economy, Japan has achieved many milestones with consistent and somewhat abnormal debt leverage in proportion to the country’s gross domestic product, so the Bank of Japan doesn’t really have anymore the ability to utilise the money market interest rate tool to stabilise the Japanese Yen exchange rate in FX markets, crucial for ordinary price stability, consumer purchasing power, and financial flows in the global economy. In so far, the choices seem quite constrained and fairly limited. Bank of Japan and the Economy Minister can allow Japanese Yen devaluation praying the currency won’t plunge in value so much to destabilise the whole Japanese economy and financial flows, otherwise the bittersweet choice could be of Fiscal restraint and moderate deleveraging hoping to strengthen the Yen in FX markets, although there could also be a less palatable option that could see Japan’s Ministry of the Economy continuing to intervene in FX market, that could force the Bank of Japan to sell outright United States Treasuries reserves which are plenty and that move can potentially become quite disruptive for financial markets.

Once upon a time, deficits and debt/GDP ratio seemed to matter, although probably if you lived on a remote island in the Pacific Ocean, perhaps the Trobriand islands among the Trobrianders or perhaps among the Arutas you were taught to believe that all women were impregnated by the spirit of the Totem and so all of their children were named after their tribe Totem, so that they could be all recognized to pertain to the same tribe and thereof exogamy could be enforced. So if deficits and debt/GDP don’t matter probably you can also be a believer that women become pregnant because of the virtue of the Holy Spirit, for what a taste of sakè can make the day.

Unless the praxis of balancing the economy could become an actual notion among Japan’s Ministry of the Economy, Transport and Infrastructure economists, then deficits, debt/GDP ratio and private debt/GDP ratio could actually matter for which there aren’t positrons spinning around to mess about with.

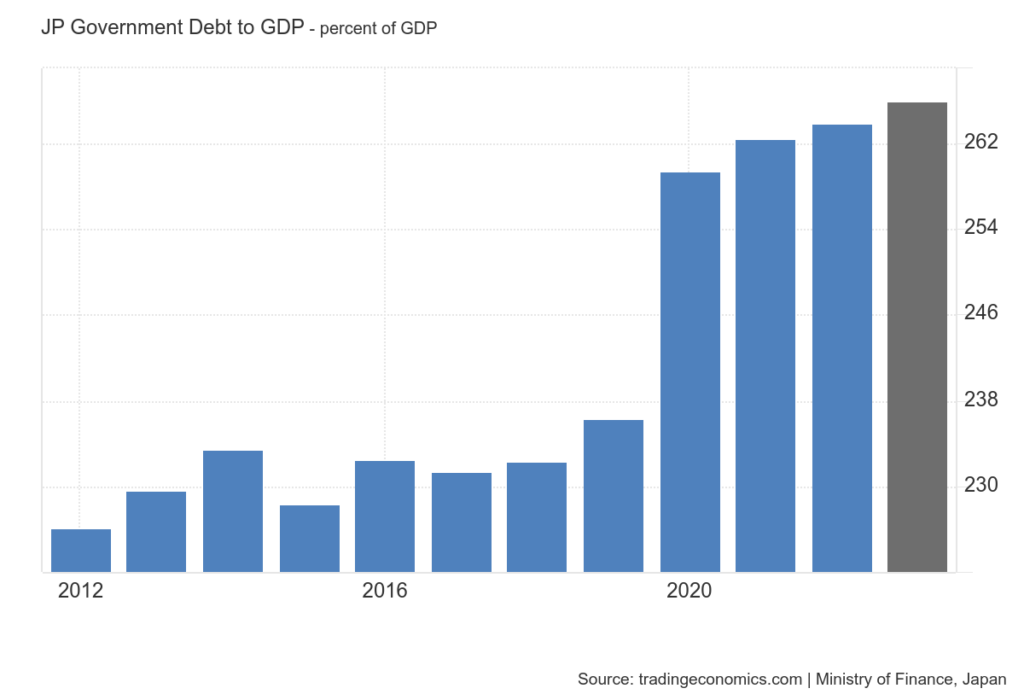

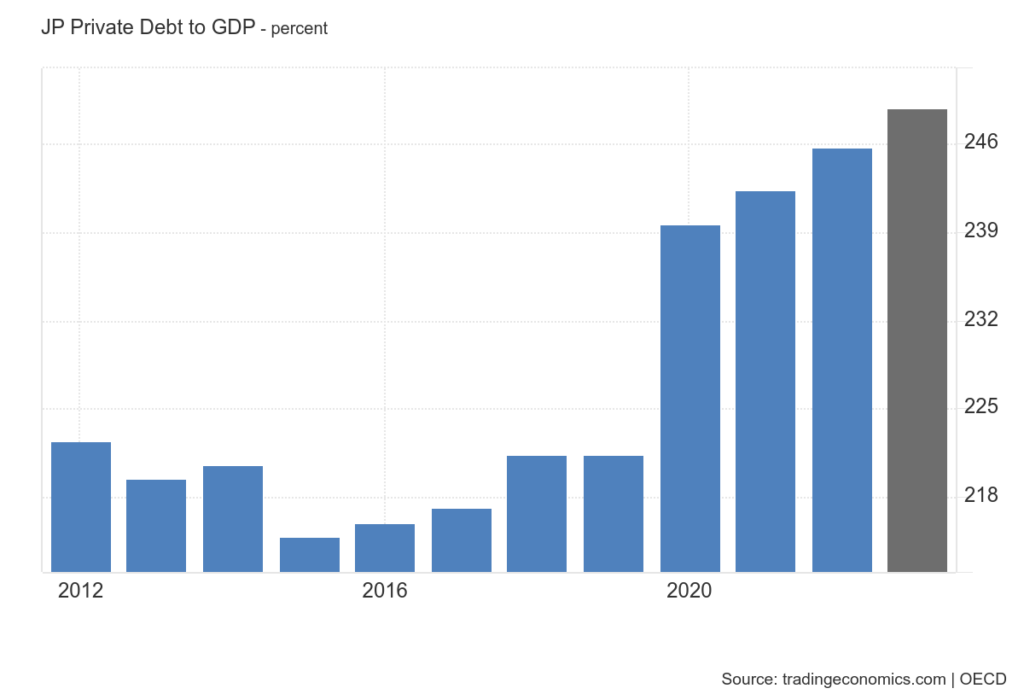

When you observe data of the debt leverage floating around Japan’s economy then you can be staggered by the leverage ratios, the quiet Japanese indulging on tasty sakè have drunk themselves in. Japan’s gross public debt/GDP ratio 261,29% meanwhile the Private Debt/GDP ratio stands at 246%. Making sense of these levels of Public Debt and Private Debt leverage could be quite difficult, although it’s well established that the Bank of Japan and the Minister of the Economy have always directed investment across all industries and main economic activities in the private sector as a coordinated public/private sectors economic framework. Nevertheless, 261% JGB public debt/GDP and 246% Private Debt/GDP ratio actually make the Japanese economy a black box at the edge of matter and antimatter deficit levels, always spinning around the Schwartzchild radius boundaries, an unknown of unknowns equilibria.

Have you ever read about Fiscal deficit and primary account surpluses?

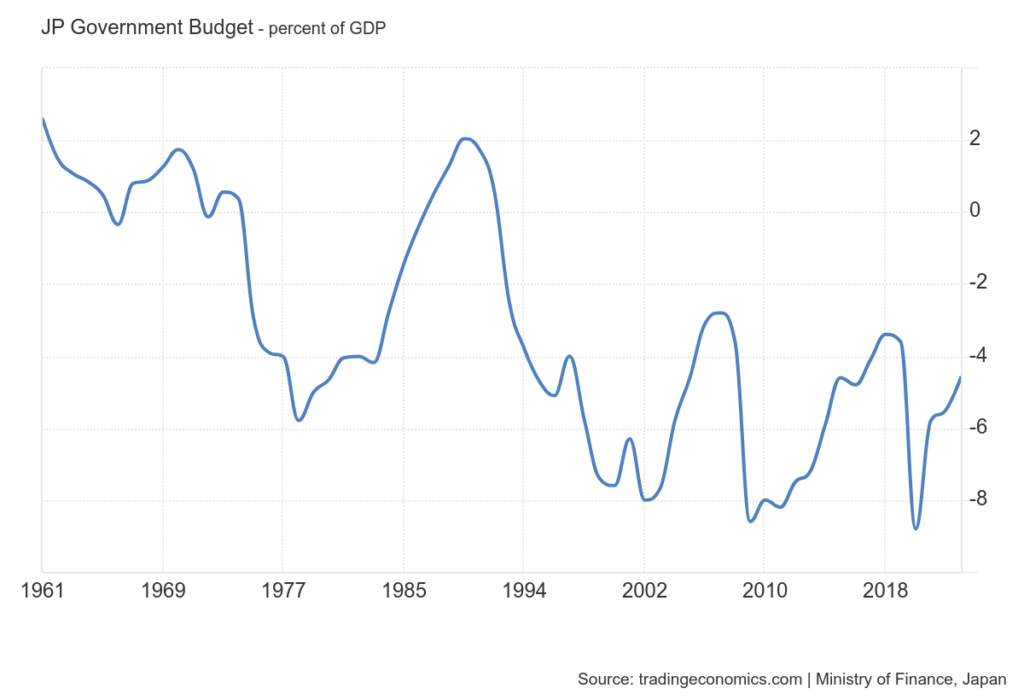

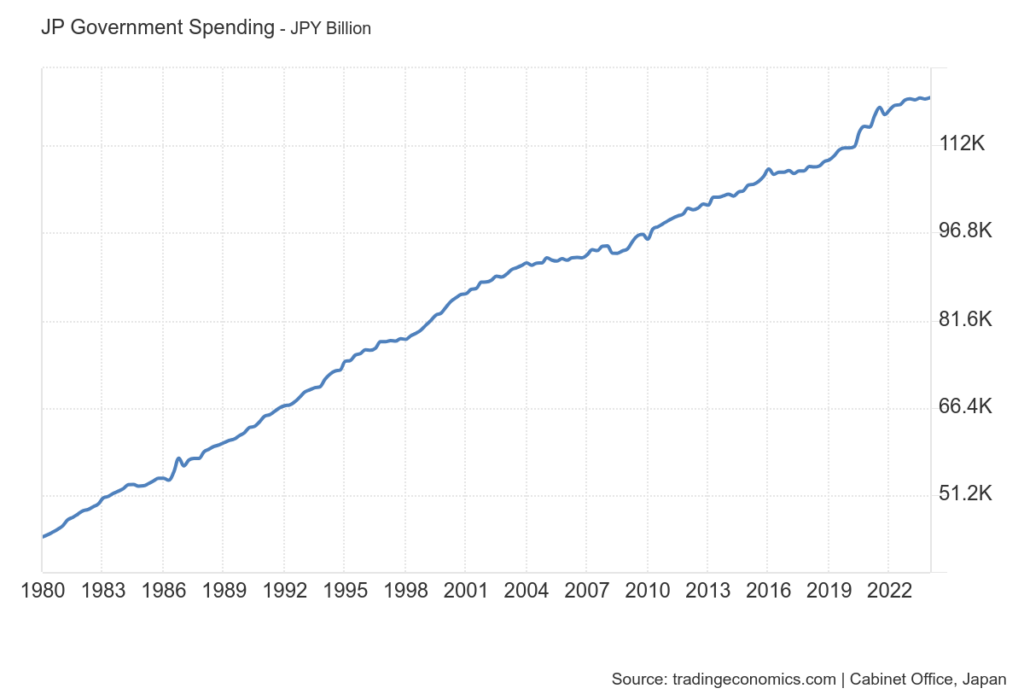

Japan’s Government Budget to GDP has consistently been across time a deficit spending machine that abundantly financed the Japanese economy with mixed results, with much praise of the ordinary Japanese men and women who thanks to their millenary culture have managed to keep prices in the economy stable. On the other side, the Japanese Government has had constantly to grow its Government Spending in the economy while actually rising to very consistent levels at the tune of JPY 120,1 Trillion Yen, indeed, JPY 120110 Billion Japanese Yen, that equates to about 44% of the overall economy, that means 44% of Japan economic output it’s purchased and consumed by the Japanese Government and all its branches and brands including the yakuza masseuse and sakè. At some point, the rationality of financial flows and excessive depreciation of the Japanese Yen could actually begin to matter, so that the BoJ and Japan’s economy minister will have to pop the very, so long waited question: ” How’re we gonna sort this out?”

At first, the brilliant idea at the BoJ and the Ministry of Economy has been, we could devalue the Yen and carry on exporting more Jacuzzi, while the Yakuza provide the masseuses, publicize everything on TikTok, praying the holy spirit of sakè the wife doesn’t find out. The carry-on Yen devaluation business worked well to keep happy the Ugly Americans with Jacuzzies, Geisha masseuses and sakè, until the sakè became too much and then something turned sour, even to find a hangover remedy with noodles ramen soup, the sakè hangover had become so strong that the fragile Japanese Yen equilibria tips over and the hangover turns in a very volatile affair, such that, even your neighbour next door, asks you ” hello pal, do you know what went on last night?” and the Ugly American goes: “nothing, we bought a Jacuzzi recently but my wife doesn’t like it much, she says it makes too many bubbles and then she finds some strange holes on her legs’ skin, and she said, “no, it’s not that I’m fat and I’ m having too much sushi and less tofu, it’s the bubbles that make my skin flabby”.

The Yen has stretched as far as possible USD/JPY 120.5 will be the next stop. “Have you ever travelled on a Shinkansen”?

Marvel of mighty Japanese engineering, a wonder of the railways’ world, the Shinkansen isn’t a normal train with a normal locomotive torque, the Shinkansen needs its own railway tracks to operate and when the Shinkansen goes, then it goes and it goes fast at about 200 mph, however, to have such a fast transportation, the costs are about JPY 350 billion Yen for infrastructures and some JPY 380 Billion Yen to assemble the actual train. Not so sure, the BoJ would like to see the Japanese Yen devalue and depreciate when considering the costs afforded to build Japan’s economy and its fast railways.

Next stop USD/JPY 120.5

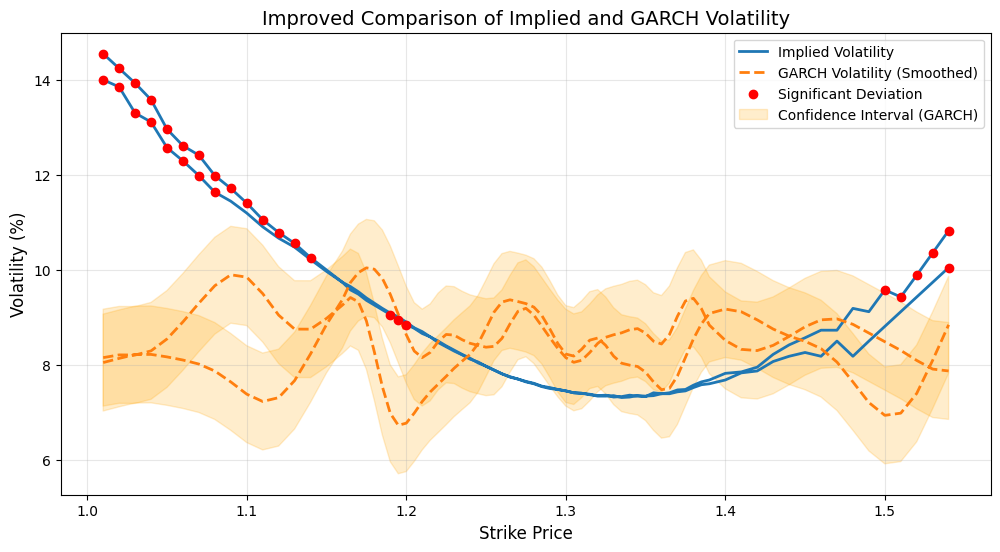

If USD/JPY travels at the speed of a Shinkansen then volatility could be high but understandable, however, if the Japanese Yen begins to reprice the exchange rate at the speed of the SCMaglev moving at the speed of magnetic field levitation, well the FX market in all probabilities will step into the unknown and the way down to USD/JPY 120.5 can become quite fast indeed, magnetic field speed do matter and can move larger density masses with very brute force.

What about the Ugly Americans, should we all believe in the Dollar ?

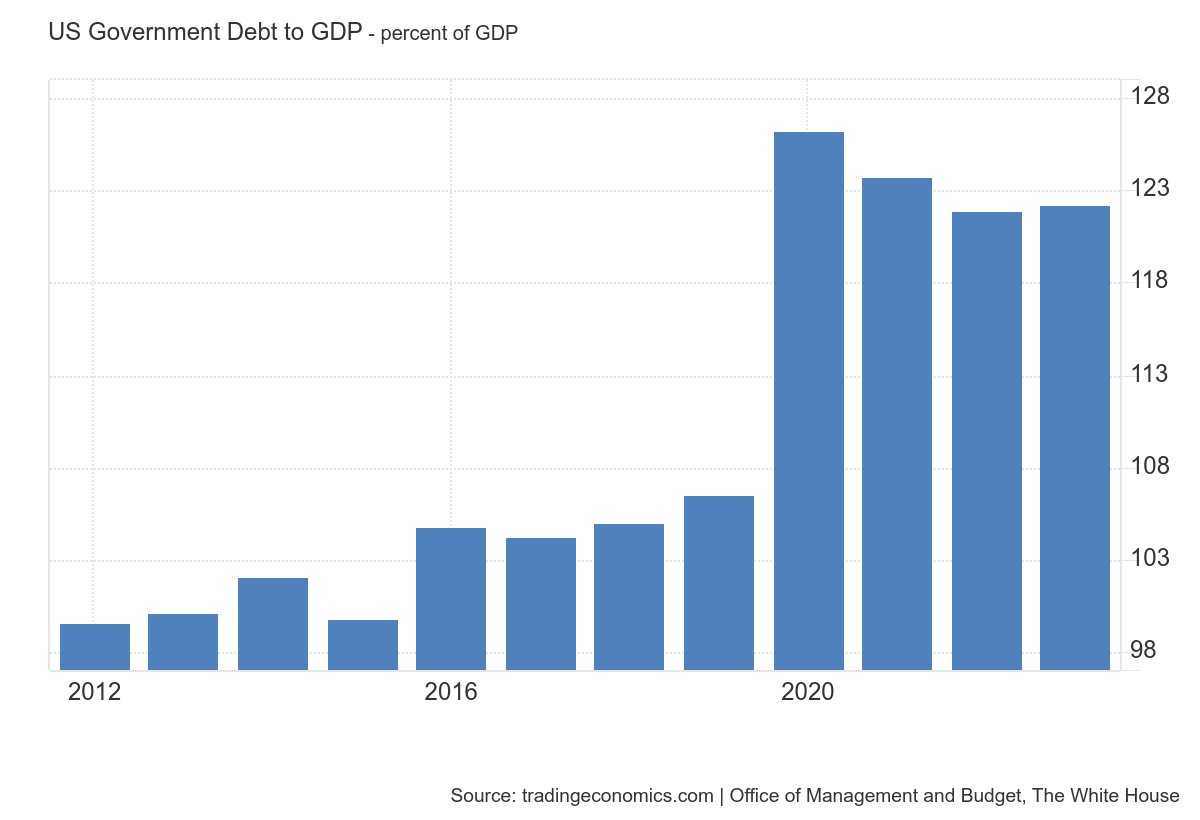

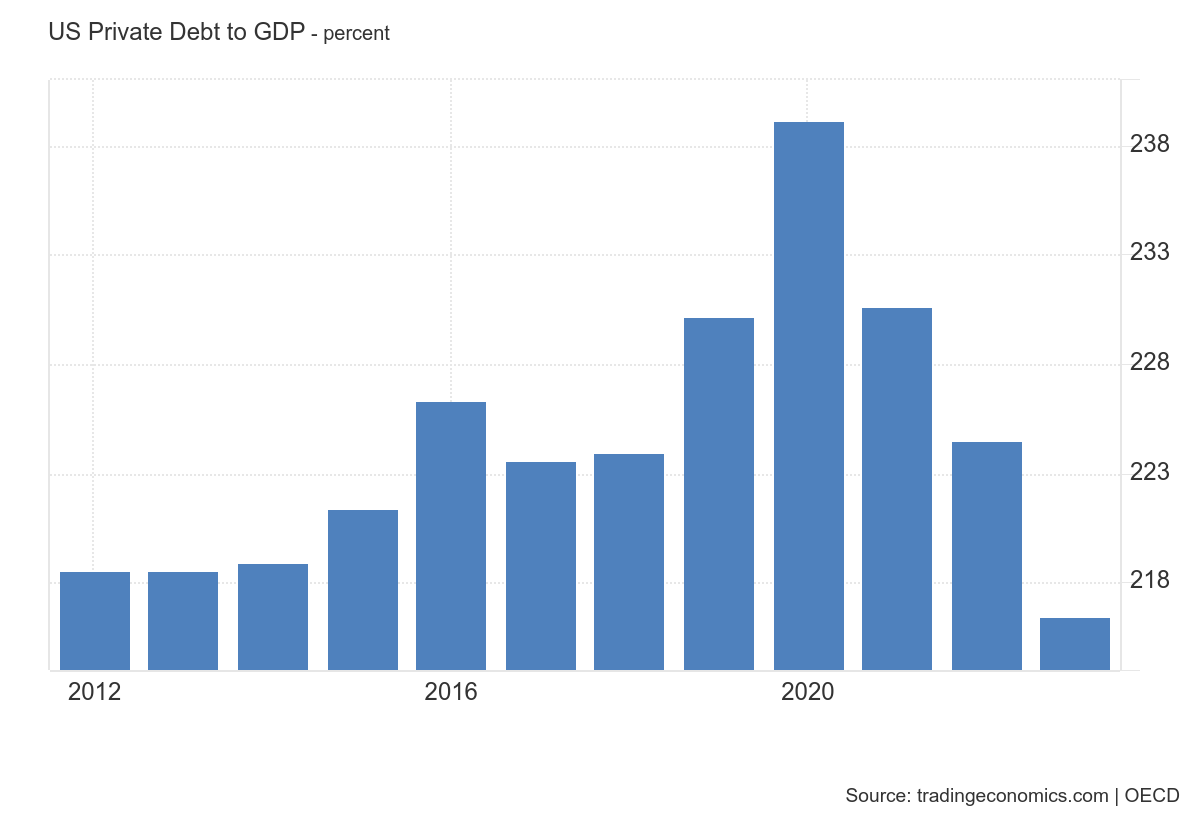

In the space-time of magnetic fields the density mass of the Ugly Americans’ Federal Government Debt/GDP ratio equates to 122.3% and the Private Debt/GDP ratio 216.5%, hence asking the global economy to believe in the stability of the U.S. Dollar, it’s exactly to argue ” In God we Trust”; considering the zero the unit of nothingness, whether before the decimal or after, so to argue, that the more zeros there are after a natural integer, the artificial value of nothingness becomes inflated, so to say that $ 1’000’000 mln is more valuable than $1’000’000’000 billion, especially when the marginal utility of the additional dollar becomes nothingness relevant on 5.98*10^24 Kg mass density. When considered the amounts of rollover in terms of the United States and Japanese deficits both Government Spending Deficit, and Private Debt, then the U.S. Dollar can hardly find any way in trying to appreciate its exchange rate and attract financial inflows to fund Treasuries issuances.

The U.S. economy consistently requires funding for Treasury issuance. Amid a decelerating global economic landscape, the U.S. Dollar has likely seen an appreciation that exceeds its intrinsic value. The U.S. Dollar Index (DXY) has probably peaked and is expected to stabilize around DXY 90, which will see a potential decline of approximately -12.8% having to factor any variations in Dollar money market interest rates differential with other currencies and Treasuries Yield Curve term structure.