A macroeconomic interpretation of the Federal Reserve shrinking its balance sheet could be that q(t)=1+C'{I(t)}, the value of one more unit of capital= cost of getting one more unit of capital, as money markets interest rates rise to match inflation and reflect real money supply and the Federal Reserve decreases its aggregate levels of Treasuries and MBS holdings, in part draining liquidity from financial markets.

In fact, the value of 1 unit of capital = the ratio between marginal productivity of capital/rate of return (interest rate)

that also requires equilibria between PI(k) marginal productivity of capital, also defined as the rate of return on investment to be equal to the rate of return on bonds, interest rate.

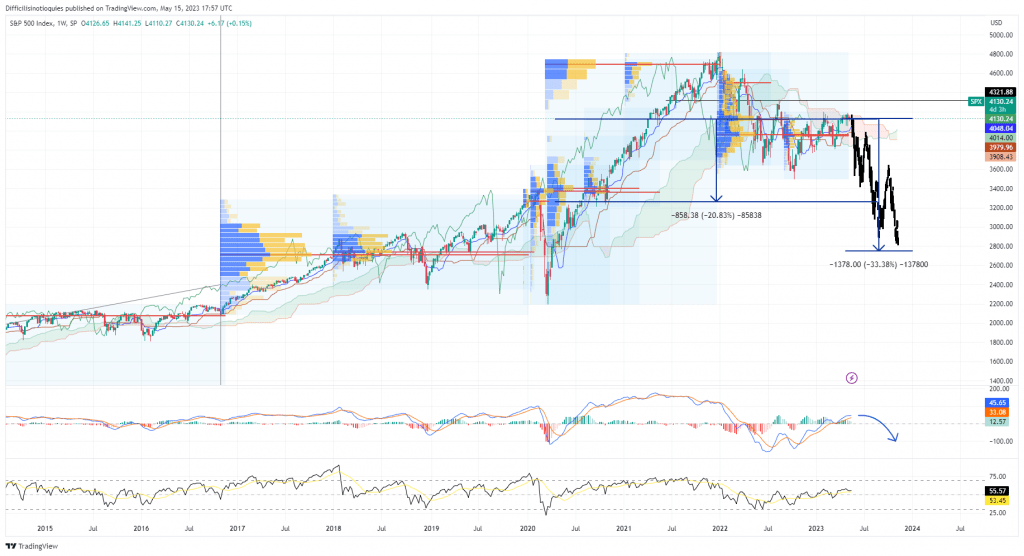

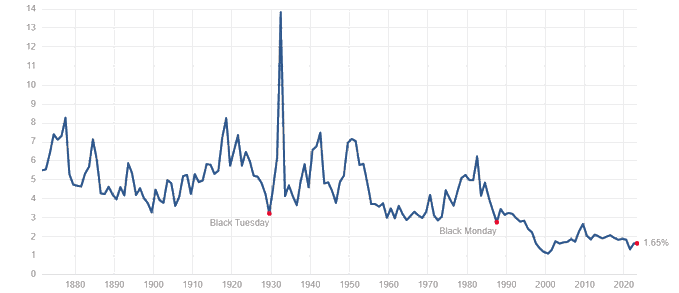

that also means that for example the dividend yield of a stock also of an index needs to be in equilibria with the Federal Fund rate of 5%<5.25%. The S&P500 Dividend Yield= 1.65%.

In the chart, it’s possible to see the S&P500 dividend yield increasing during periods of stock market volatility and distress, in fact with financial crisis the ratio between the S&P500 dividend and the S&P market value, with the denominator shrinking provides a higher ratio.

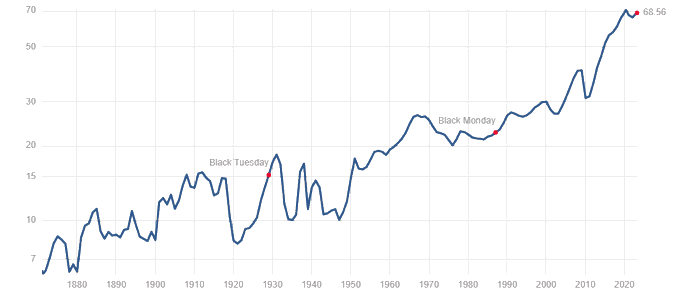

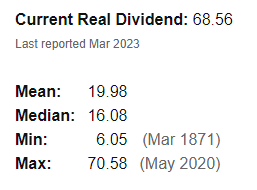

The S&P500 dividend is actually at a double top of 7058>68.56, about 3.4 to 4,25 times the average and median values. The S&P 500 Dividend could have to be slashed to 30.

Factoring in 5.0%<5.25% Federal Fund rate and the actual S&P500 $176.5 Earnings, the S&P500 must decrease its value to SPX 3350 a stock market value priced already in the ratios.

There are two possible scenarios. With 176.57 earnings the S&P500 will see a -20.5% CORRECTION to SPX 3350>3250, for a $170 SPX Earnings per share. That depends on the Fed hiking to 5.5%, probably, and stocks guiding for lower dividends and EPS. In fact, considering S&P500 listed companies guiding for lower Earnings per Share and Dividend payments, while the economy slows down and the Federal Reserve could see necessary hiking to 5.25%<5.5%. The S&P500 needs to have a concrete market correction of -33.5% to SPX 275. S&P500 scenario with earnings of $140 dollars and SPX 2750 = 5% dividend yield, in line with Federal Fund rate. Of course, the Federal Reserve then going down to 2.5%, would make SPX 2750 Earnings $70. 2007/08 scenario of $100 decrease in S&P Earnings.