Leverage effect could bring seasonal Q1 stock market drawdown

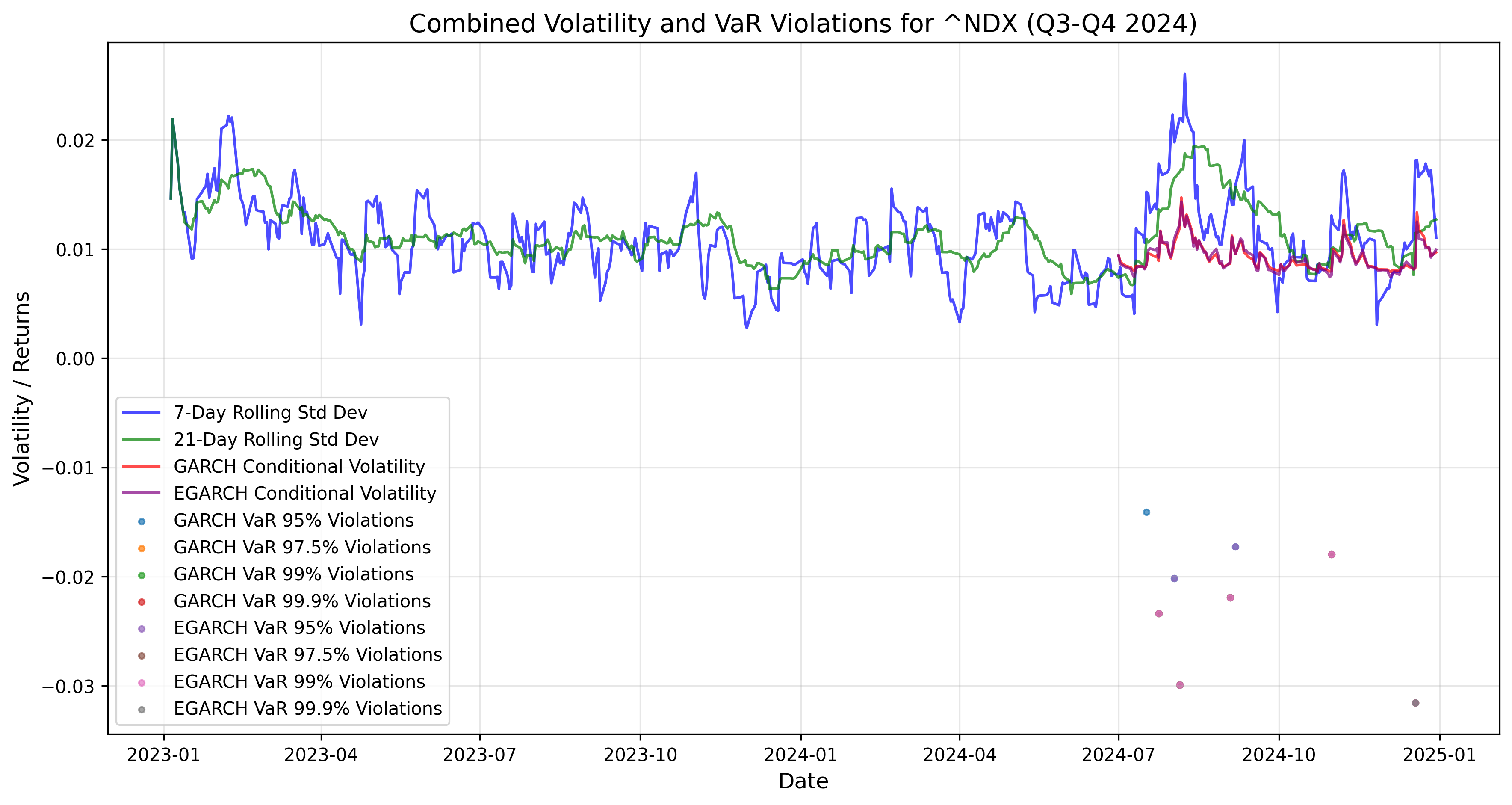

The recent Q4 volatility patterns of the major U.S stock market Index, such as Dow Jones Industrial Average, S&P500, Nasdaq100 and Russell 3000 could have been a forthcoming market signal of a volatility build-up going into Q1 2025, as among…

FTSEMIB timeseries volatility study and -26% volatility risk scenario

An extensive time-series analysis has been carried over the FTSEMIB to gather statistical parameters and analyse the FTSEMIB daily and cumulative returns volatility patterns. The FTSE MIB chart has already been drifting in a sideways pattern after a BollingerBand technical…

Forecasting Value-at-Risk under Fat-Tail Distribution Assumptions

Financial Econometrics studies have demonstrated that forecasting Value At Risk under standard normal distribution conditions could lead to underestimation of potential losses, hence of fat tail volatility risk events, other methods to improve Value At Risk forecasting have been studied…