Unveiling the Complex Tapestry of Stock Market Crashes: A Comprehensive Exploration

The history of financial markets is punctuated by episodes of euphoria and despair, with stock market crashes serving as ominous reminders of the inherent volatility and unpredictability of the global financial system. A stock market crash is a sudden, severe drop in the overall value of the stock market, often leading to widespread panic, economic downturns, and profound financial repercussions. This essay delves into the myriad reasons behind stock market crashes, drawing connections to historical events, stock and debt bubbles, and emphasizing the critical role of financial risk metrics in anticipating such catastrophic events.

Historical Context:

Examining past stock market crashes reveals recurring patterns and triggers. The Great Depression of 1929 is perhaps the most iconic, as speculative excesses, coupled with inadequate regulatory safeguards, led to a catastrophic collapse in stock prices. Similarly, the dot-com bubble of the late 1990s witnessed the overvaluation of technology stocks, followed by a sharp correction in 2000. More recently, the 2008 financial crisis stemmed from the burst of the housing bubble, unraveling intricate financial instruments and exposing systemic vulnerabilities.

Stock and Debt Bubbles:

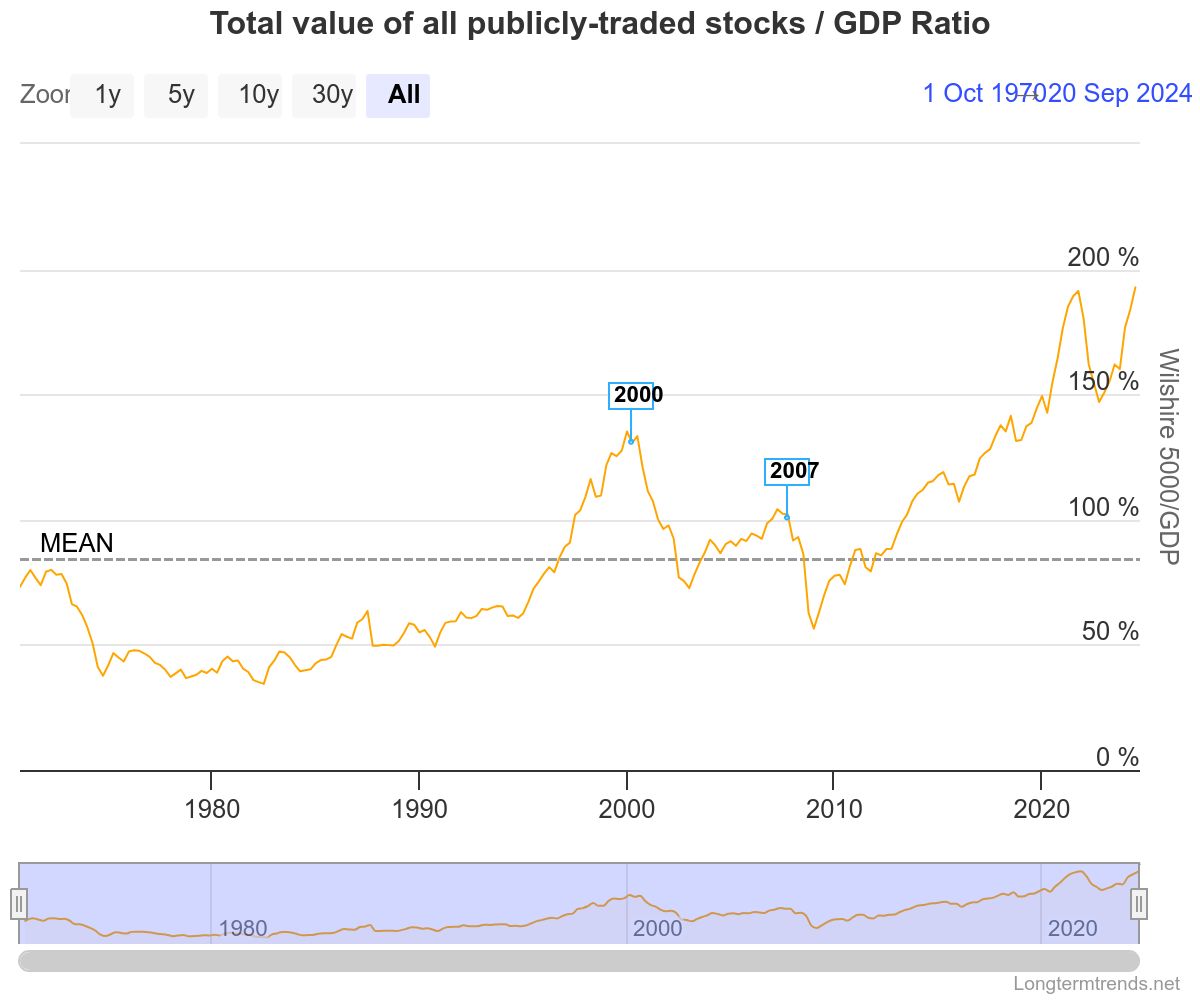

Stock market crashes are often precipitated by the formation and subsequent burst of stock and debt bubbles. A stock bubble occurs when the prices of stocks significantly exceed their intrinsic values, driven by irrational exuberance and excessive optimism. During such periods, investors may become disconnected from fundamental valuation metrics, leading to inflated asset prices that are unsustainable in the long term.

Concurrently, debt bubbles can exacerbate the fragility of financial markets. The accumulation of excessive debt, whether by corporations, governments, or consumers, creates a precarious environment where any adverse shock can trigger a cascading effect. The interconnectedness of financial institutions amplifies the impact, as defaults in one sector can trigger a domino effect across the broader economy.

Financial Risk Metrics:

In navigating the labyrinth of financial markets, assessing and understanding various risk metrics is paramount. Here are key financial risk metrics that play a pivotal role in forecasting and mitigating the impact of stock market crashes:

- Volatility Indices (VIX): The VIX, often referred to as the “fear gauge,” measures market expectations for future volatility. An abrupt increase in the VIX may indicate rising concerns and the potential for a market downturn.

- Leverage Ratios: High levels of leverage, where market participants borrow extensively to amplify returns, can amplify losses during downturns. Monitoring leverage ratios provides insight into the vulnerability of the financial system.

- Debt-to-Equity Ratios: Elevated debt levels relative to equity can signal financial distress. Excessive leverage magnifies the impact of market downturns, making companies and financial institutions more susceptible to insolvency.

- Market Valuation Metrics: Metrics such as the price-to-earnings ratio (P/E) can offer insights into market valuation. Historically high P/E ratios may indicate overvaluation, warranting caution.

- Macroprudential Indicators: Monitoring broader economic indicators, such as unemployment rates, GDP growth, and inflation, provides context for assessing the overall health of the economy and potential risks to financial markets.

- Liquidity Measures: The ease with which assets can be bought or sold without causing significant price fluctuations is a crucial factor. Illiquid markets can exacerbate the impact of a sell-off.

Stock market crashes are complex phenomena driven by a confluence of factors, including historical precedents, bubbles, and systemic vulnerabilities. By paying close attention to financial risk metrics, investors, regulators, and policymakers can enhance their ability to detect early warning signs and implement measures to mitigate the impact of market downturns. As financial markets continue to evolve, a nuanced understanding of the intricate interplay between historical context, market dynamics, and risk metrics remains essential for navigating the unpredictable terrain of global finance.