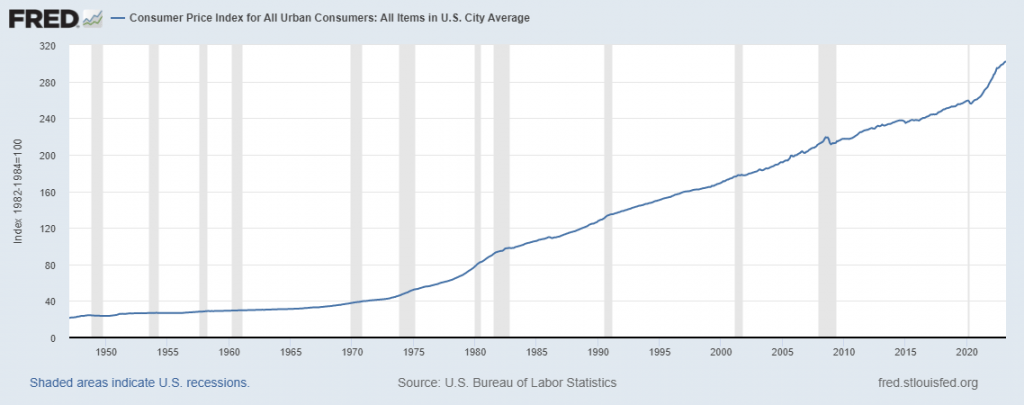

Economies with persistent large deficits financed by borrowing, become prone to sustained higher inflation

Economies with persistent large deficits financed by borrowing, become prone to sustained higher inflation. When deficits become too large eventually there’s no amount of money printing that plugs the deficit hole.

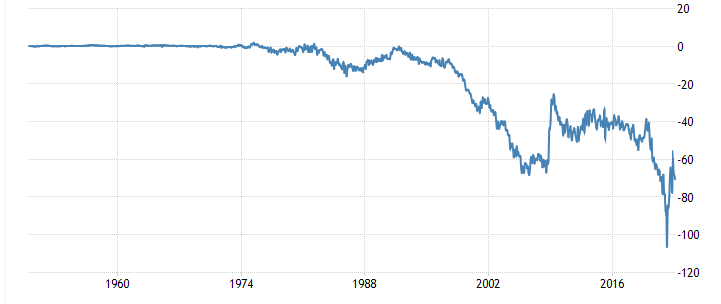

U.S. Balance of trade

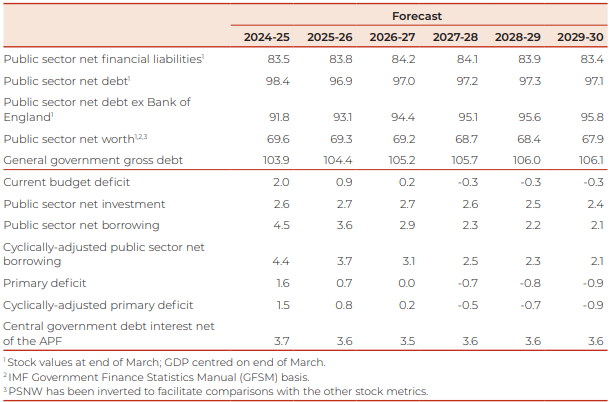

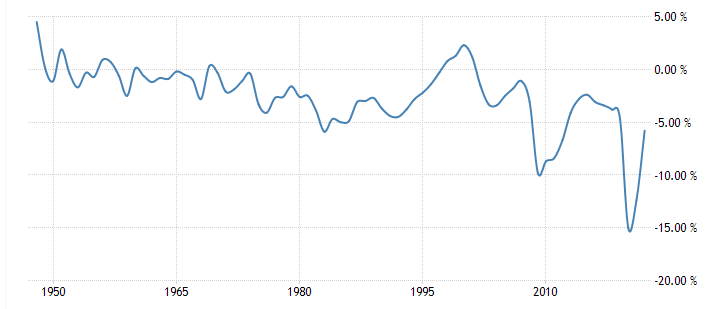

U.S. Budget Expenditure to GDP

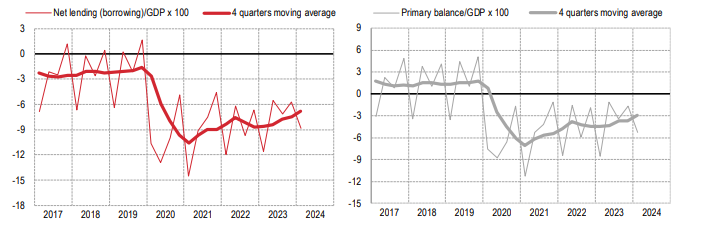

Graphs are the U.S. balance of trade & fiscal deficits. The American economy has run on primary accounts deficits for decades and becomes evident that deficits have become larger, signs of imbalances and excess borrowing to finance deficits, that have produced very high inflation. These make the United States economy widely unstable and with rising risks of Fiscal deficit meltdown.

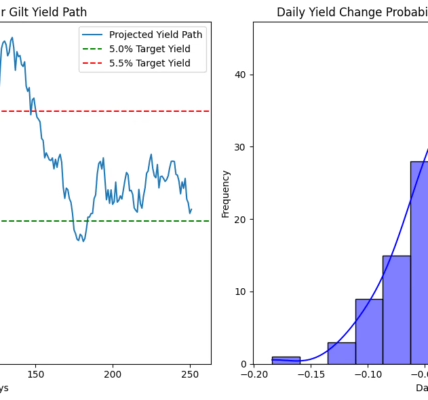

The effects of rising interest rates and decreasing money supply, implied changes in the money market equilibrium. Therefore, hundreds of billions of dollars of deposits have been allocated into money market funds balancing the real money supply and money market equilibrium. Therefore, money market funds have raised interest rates in real terms to match inflation in order to preserve real money, vis a vis the declining money supply from the Central Bank. Money market equilibrium requires real money supply=money demand.

Mispriced interest rate risks in banks’ balance sheets and investment funds don’t guarantee real money supply equilibrium in terms of inflation and real interest rates.