After the record highs in stocks from Tokyo to New York City, global markets show a mixed picture while taking stock of the American administration’s tour of Asia and the prospective trade deals and softening position of the U.S.-China trade developments, meanwhile looking forward to Central Bank decisions, futures prices indicate a slight pullback in early trade after record-setting closes for the major indexes, as investors await key Federal Reserve decisions and scheduled US-China trade discussions this week. Market sentiment remains optimistic but cautious, with technology and semiconductor sectors leading gains in the Nasdaq and broad risk-on appetite supporting the Dow and S&P 500 rally.

| Index | Last Close | Daily Change | Key Drivers & Sentiment | Futures Price (Oct 28, 2025) | Futures Change % | Yahoo Finance Chart | Barchart Chart |

|---|---|---|---|---|---|---|---|

| S&P 500 (SPX) | 6,875 | +1.23% | Trade optimism, strong earnings, rate cut expectations. “Cautiously bullish” tone. | 6,901.75 | -0.09% | Yahoo S&P 500 | Barchart S&P 500 |

| Nasdaq 100 | 25,833 | +1.83% | Outperformance led by semiconductors like Qualcomm, Nvidia. | 25,947.25 | -0.06% | Yahoo Nasdaq 100 | Barchart Nasdaq 100 |

| Dow Jones (DJIA) | 47,531 | +0.71% | Broad-based gains on improved risk appetite | 47,697.0 | -0.03% | Yahoo Dow Jones | Barchart Dow Jones |

European Markets have opened modestly lower, after the Euro Stoxx 50 and Stoxx 600 pushed to record levels, where the performance was led by autos and industrial tech stocks. Meanwhile, Asian-Pacific Markets overnight have traded lower despite trade optimism. Japan’s Nikkei fell 0.58%, Hong Kong’s Hang Seng dropped 0.62%, and mainland China’s indices also saw slight declines. The Sensex and Nifty slipped in range-bound trade as profit-taking set in following recent gains.

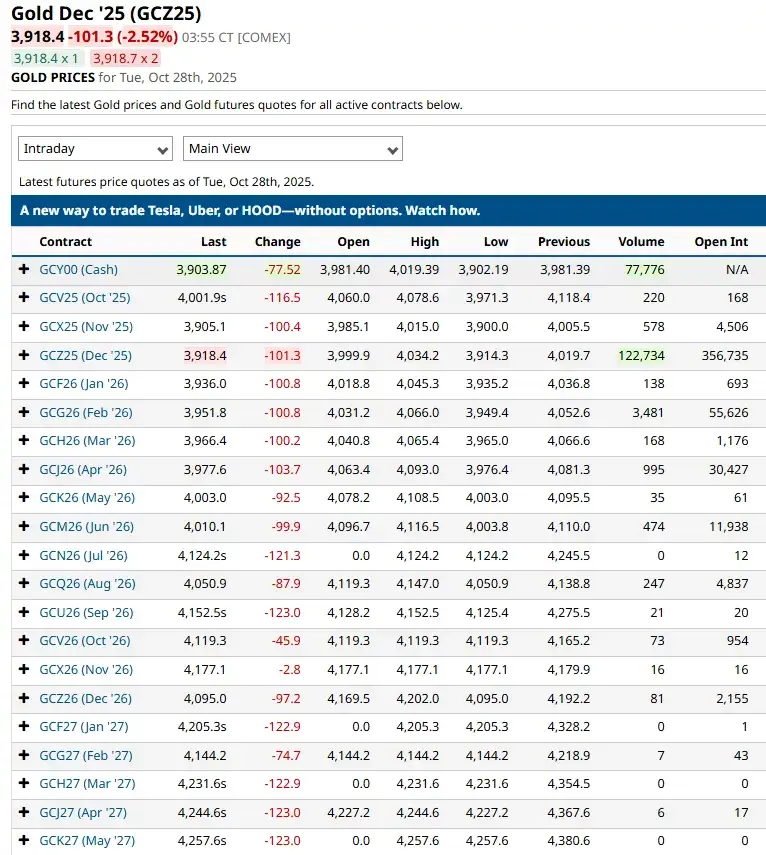

Commodities Markets & the Gold Liquidation Trade

Gold’s correction -2.52% is gathering pace, with prices breaking below key support levels to new lows while Silver also has been drifting -2.1%, in the futures markets, there aren’t particular reasons for precious metals prices decline and higher volatility, if not a liquidity move to cash and liquidate long Gold and Silver positions which have become overextended and largely overbought, although Gold Futures curve prices in rising prices above $4000 for 2026 and 2027. Crude oil futures were trending lower, hovering around $60.22 per barrel, with volatility in energy prices because of two main factors such as Global Crude Oil supply outpacing global demand, and a potential slowdown in aggregate Chinese economy demand, meanwhile, the market seems to discount completely a cut-off of Russian Oil supply.

Sovereign Debt Markets

Sovereign Debt market showed signs of appetite for long-duration bonds, in the spectrum of 10y to 30y duration, withstanding broader Inflation metrics in some countries consistently and persistently drifting from the 2% price stability aim, although long-term U.S. 10Y Breakeven Inflation is 2.3% price in a moderate inflation environment in the longer term. What to see will be the upcoming Federal Reserve FOMC meeting in terms of monetary policy, although the possibility of a 25(basis point) decrease in the Federal Fund rate have been widely priced in equities markets, with the latest junk rally, mean while long-duration Treasuries have showed signs of investors being interested in the actual levels of Yield-to-Maturity, while also the overnight REPO market has been lately spooked by demand for collateral and signs of liquidity distress.

| Country / Region | 2-Year Yield | 10-Year Yield | Key Moves & Context | Yahoo Finance 2-Year Chart | Yahoo Finance 10-Year Chart |

|---|---|---|---|---|---|

| United States | 3.49% | 3.97% | Yield decreased slightly amid the Eurozone cautious sentiment. | US 2Y | US 10Y |

| Germany | N/A | 2.60% | Yield decreased slightly, reflecting cautious domestic demand. | N/A | Germany 10Y |

| United Kingdom | N/A | 4.38% | Yield decreased slightly, affected by BoE policy expectations. | N/A | UK 10Y |

| Japan | N/A | 1.64% | Yields relatively stable amid mixed global signals. | N/A | Japan 10Y |

| Canada | N/A | 3.05% | Yield decreased slightly despite resilience in North American markets. | N/A | Canada 10Y |

| Australia | N/A | 4.17% | Yields are relatively stable amid mixed global signals. | N/A | Australia 10Y |

ETFs Performance and Flows

XBI (SPDR S&P Biotech ETF): The fund’s net asset value (NAV) is $111.59 with assets under management of over $6.7 billion. It seeks to track the S&P Biotechnology Select Industry Index, providing diversified exposure across large, mid, and small-cap biotech stocks. IBB (iShares Biotechnology ETF): The ETF closed at a new high of $157.11, which also matches its 52-week high. ARKG (ARK Genomic Revolution ETF): While it saw a pullback in its latest trading session, its Year-to-Date (YTD) return of 42.71% confirms its status as a strong performer, significantly outpacing its category average. VOO (Vanguard S&P 500 ETF): As a broad market gauge, its positive movement and 15.62% YTD gain reflect the ongoing strength in the U.S. equity market, particularly in large-cap stocks.

| ETF Name (Ticker) | Previous Performance & Price | Latest Close (Oct 27, 2025) | Latest Performance | Yahoo Finance Link |

|---|---|---|---|---|

| SPDR S&P Biotech ETF (XBI) | Up 34% (6 months), Closed at $108.38 | $111.59 | +2.95% (1-day); 1-year +14.86% | XBI Yahoo Finance |

| iShares Biotechnology ETF (IBB) | Up 25%, Closed at $155.16 | $157.11 | +1.26% (1-day) | IBB Yahoo Finance |

| ARK Genomic Revolution ETF (ARKG) | Up 42%, Closed at $31.88 | $31.16 | -2.26% (1-day); YTD +42.71% | ARKG Yahoo Finance |

| Vanguard S&P 500 ETF (VOO) | Benefiting from a strong rally | $630.00 | +1.20% (1-day); YTD +15.62% | VOO Yahoo Finance |

What’s Going On This Week

All stock market institutional investors, speculators and commentators will be waiting for the Wednesday Federal Reserve FOMC meeting and the monetary policy decision, with market expectations pricing in a Federal Fund Rate cut of (0.25%), while also waiting to hear from the Federal Reserve about the macro-economic picture, the ongoing Government shutdown and the absence of statistical data collection as points of conversation. On the equities side, with global stock markets at all-time highs, on which horse are you going to bet? Earnings data from tech companies can be the source of short-term volatility in stocks and options markets. This overflow of data should not make retail investors even more irrationally exuberant, as there are more important, less-advertised facts to consider. In this wider global cycle of debt markets and stocks, we have seen the first signs of the beginning of a default cycle, with First Brands, Tricolor, Carriox Capital II LLC (Carriox) a NewYork-based receivables company filing for bankruptcy with hidden debt of $1,0 Billion dollar, and the accessories retailer Fossil Global Services Ltd. filed for Chapter 15 bankruptcy protection on Oct. 20, seeking U.S. recognition of its UK restructuring plan as a foreign proceeding after struggling for 10 years to compete against high-tech competitors like Apple and Samsung and direct-to-consumer establishments that grabbed a significant share of the market. Meanwhile, the upcoming Halloween Trick-or-Treat amusement sees national candy distributor CandyWarehouse.com Inc. filing for Chapter 11 bankruptcy protection a week before Halloween to reorganise and restructure its debts, facing a significant drop in its revenue earlier this year. The Sugar Land, Texas, debtor filed its petition in the U.S. Bankruptcy Court for the Northern District of Texas on Oct. 24, listing $100,000 to $1 million in assets and $1 million to $10 million in liabilities, according to Bankruptcy Observer. With the default cycle silently setting in motion, something more visible and glamorous has also been announced by large multinationals as Amazon, with the announcement of a round of layoffs up to 30,000 corporate employees, nearly 10% of the whole corporate employees, as a broader strategic context, according to CEO Andy Jassy. Since late 2022, Amazon has cut over 27,000 jobs. Jassy has been focused on reducing bureaucracy, flattening organisations, and enforcing cost monitoring. In a June memo to staff, Jassy explicitly stated that the extensive use of AI across the company would lead to a smaller corporate workforce over the next few years, as “we will need fewer people doing some of the jobs that are being done today”. Amazon has been spending aggressively on AI, with capital expenditures (like data centres) expected to top $120 billion this year. The layoffs are seen as a way to pare expenses and compensate for the massive investment and overhiring that occurred during the pandemic. The Broader Tech industry has been on a cost-cutting rollercoaster, and so far in 2025, over 200 tech companies have laid off approximately 98,000 employees. Other major tech firms like Microsoft, Meta, and Google have also conducted layoffs this year, with many pointing to the increasing adoption of AI as a catalyst for changing workforce needs. What counts most it’s simply that the default cycle has started, and the job-shredding across multinationals and economies also has been gathering steam, as in fact, unemployment rates have been rising in some countries. Investors should be aware of the highly speculative valuations in markets and that the private-credit and private-equity shadow banking deterioration and default cycle will continue in the coming months and years, meanwhile higher stock prices will be a flashing warning sign of higher and higher speculative risk-taking in markets, with the prospect of much larger financial institution getting caught in a stock market drawdown, with a Global Economic Recession becoming a feasible probability in the medium term horizon, 24 to 48 months.