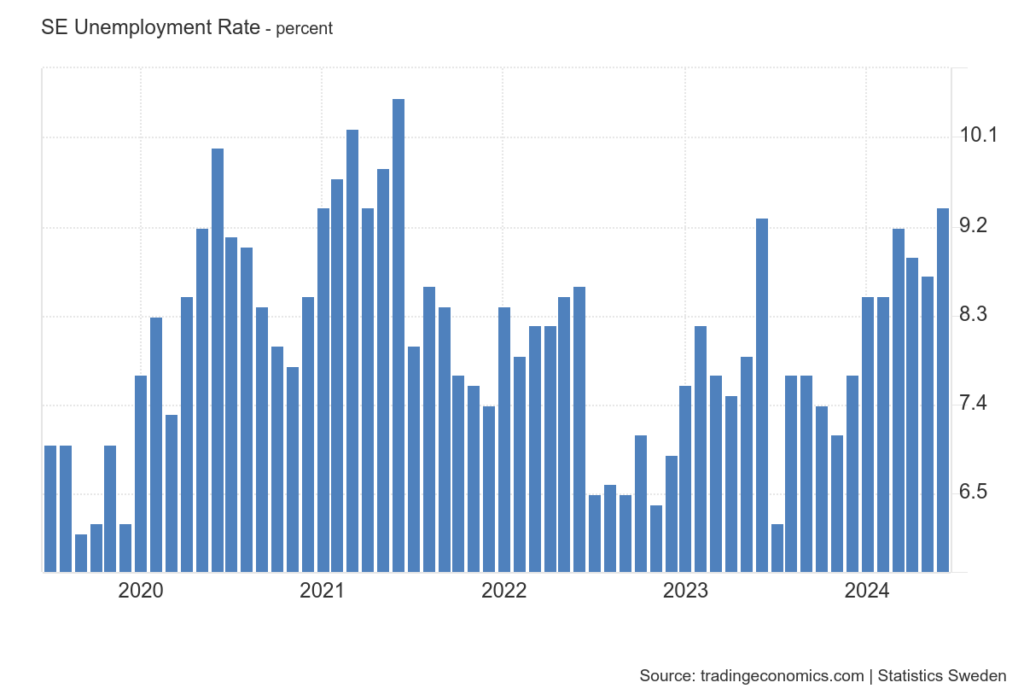

Sweden’s economic data confirm early warnings of a Housing Market Debt burst feeding into Economic Recession and Unemployment. Latest data confirm everything foresaw between 2023/24. Sweden’s Unemployment rate increased to 9.4% in June and it’s likely to be in the double digits going forward.

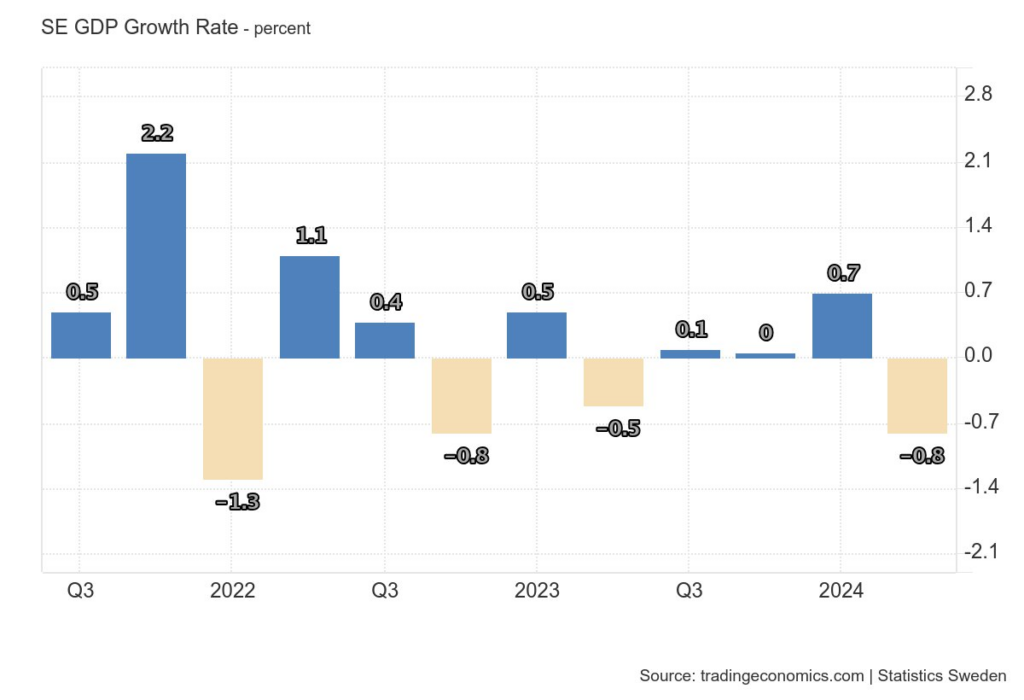

The aggregate economic output has seen a meaningful contraction in quarter-on-quarter GDP growth -0.8% making, 2024 economic growth stagnant at 0%, although it’s possible to foresee a deceleration trend and decline in aggregate economic output for 2024.

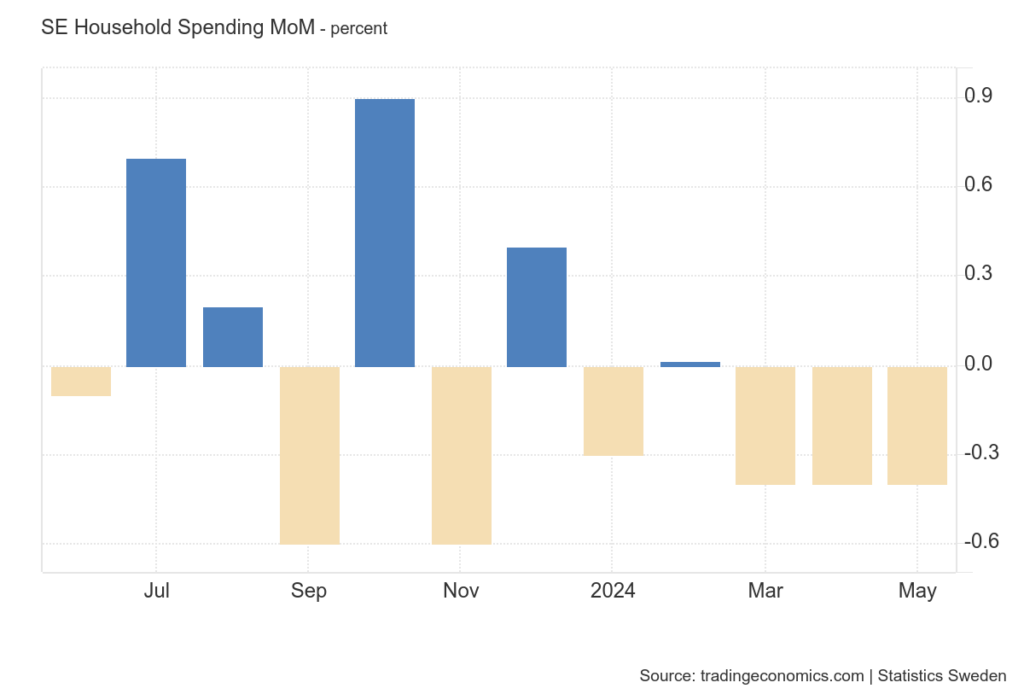

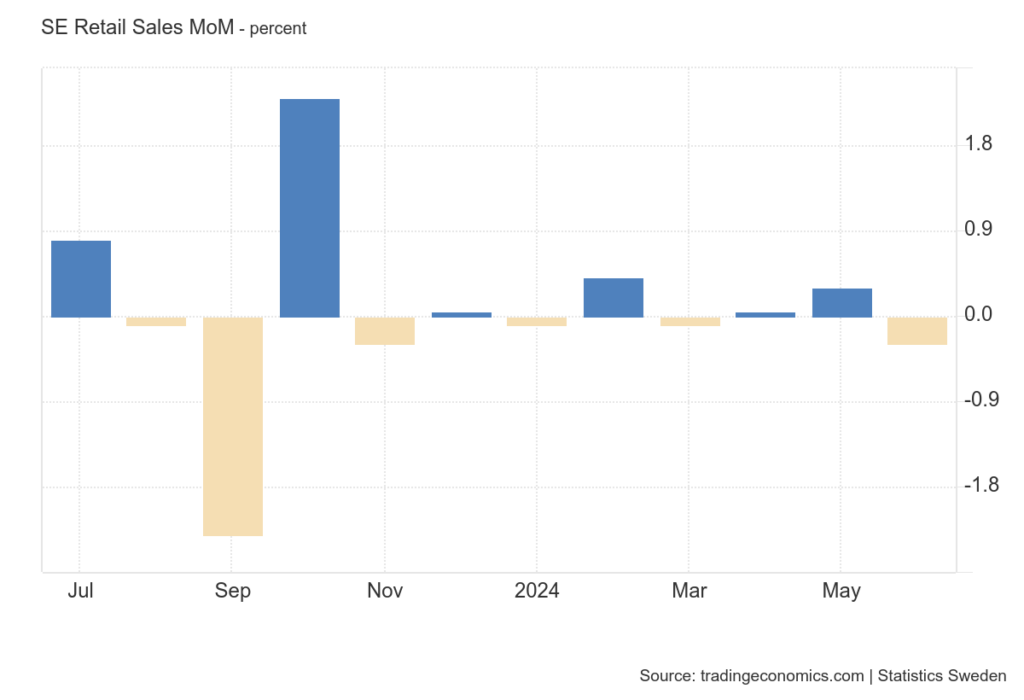

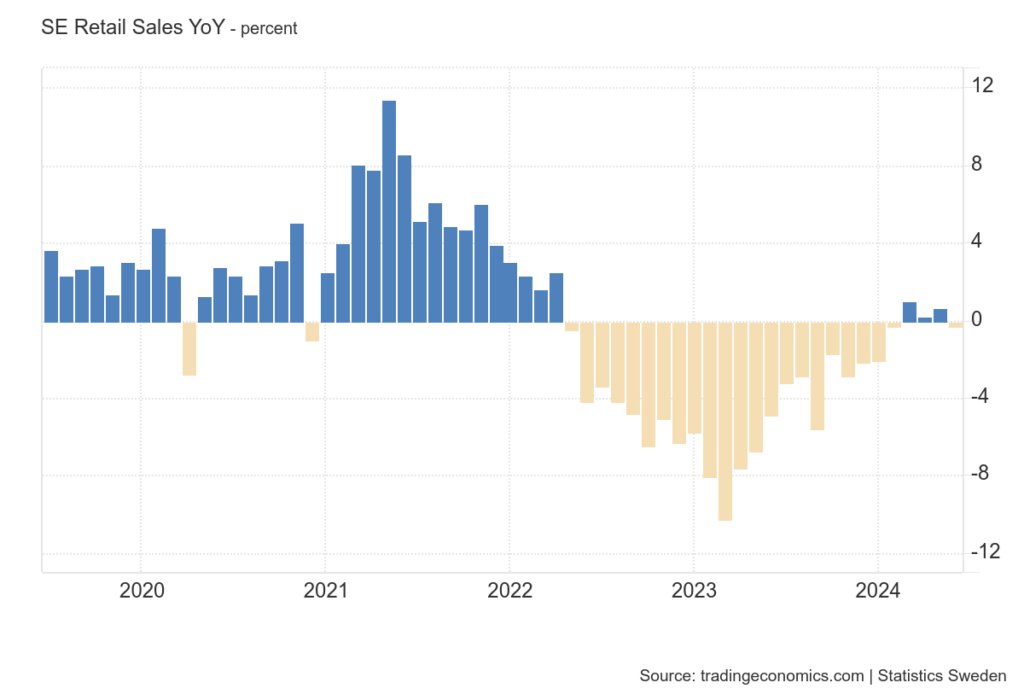

Swedish Household consumption has been recessionary during 2024, in fact, the latest retail sales data see a decline -of 0.3% in June while the broad trend has been stagnating flatlining.

Consumers’ Retail Sales data Year-on-Year chart reveals a long trend of declining retail sales and consumer expenditure contraction, initiated in early 2022. Hinting at some deeper issues of Private Credit and Related Housing Market Debt Distress on a wider scale

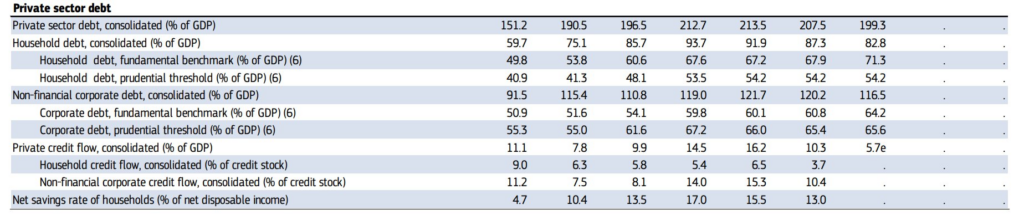

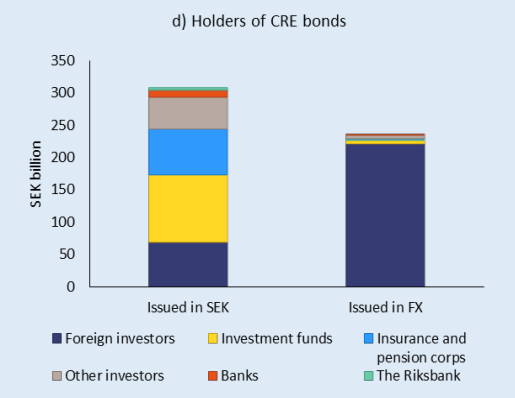

Sweden’s Commercial Property Debt and Private Debt picture are conducive to economic recession

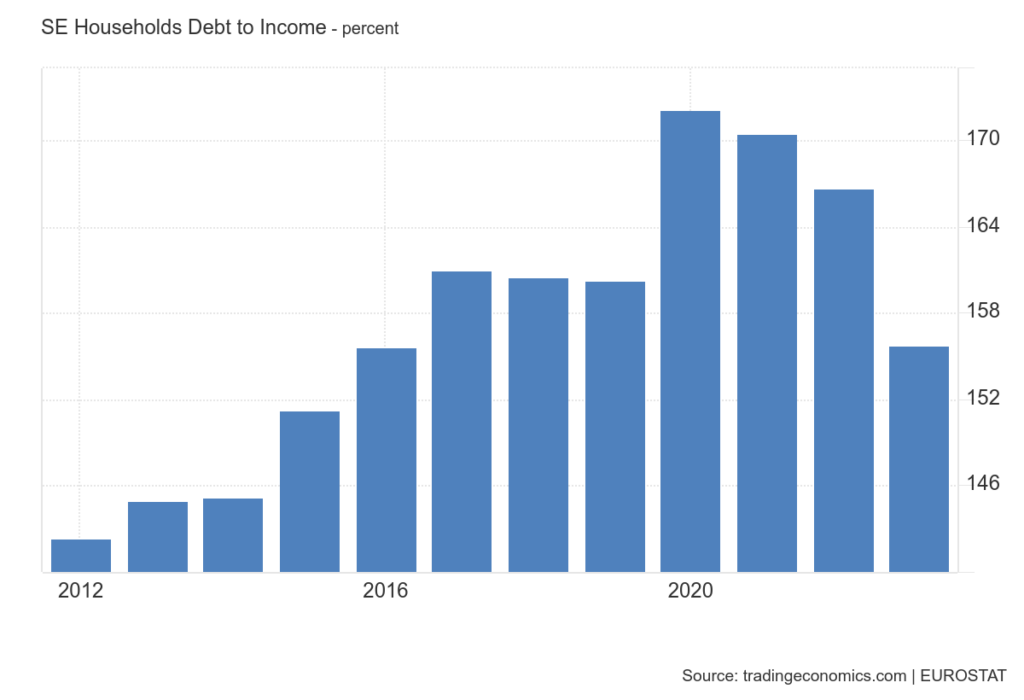

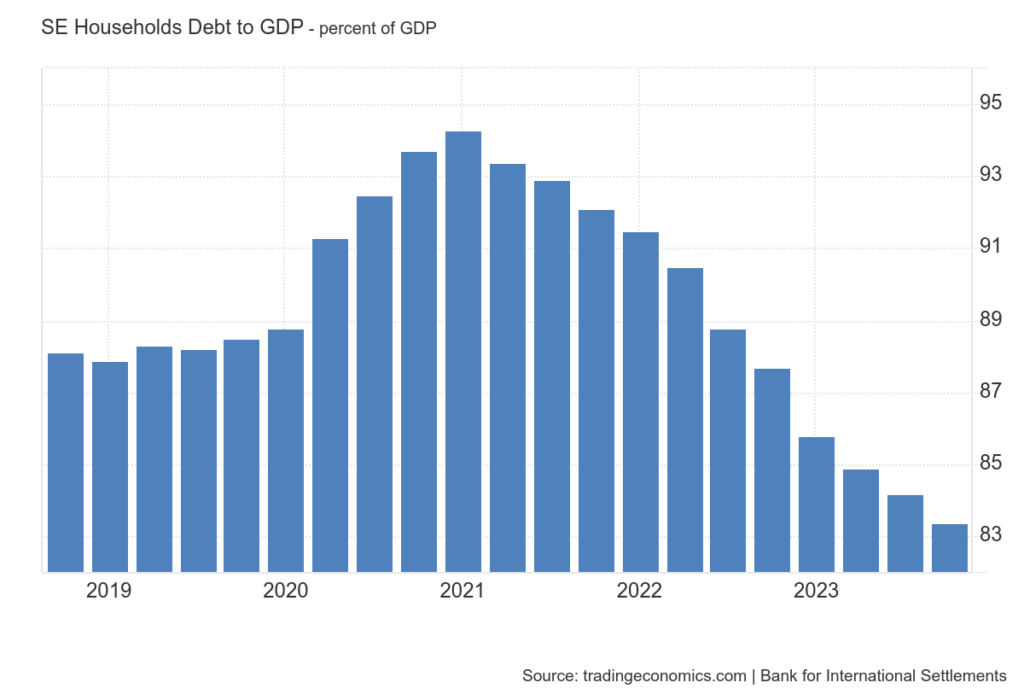

Swedish Household Debt to income bubble peaked in 2021 at 170% since then declined in a process of deleveraging to 155.76% last data, while Household Debt to GDP peaked at 93.5% in 2021 and has been deleveraging since then down to 83.4% Q4 2023.

According to the EU data country report, Sweden’s Private Debt to GDP ratio was 199.3% very high in a deleveraging process. Corporate Debt and Housing market debt distress are affecting Sweden’s economic growth dynamics, while Corporations follow through on deleveraging and defaults.

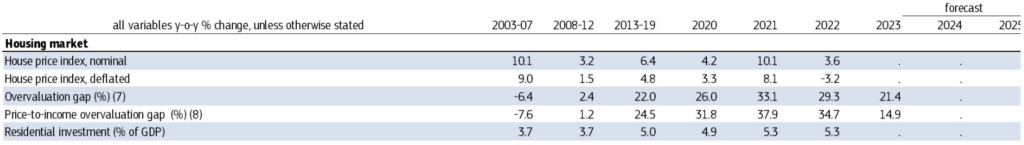

meanwhile, another important feature of the Swedish economy has been highlighted in the House Prices Overvaluation Gap that peaked at 33.1% in 2021, 29.3% 2022, 21.4% 2023, still a large Overvaluation Gap in the Housing Market and Real Estate, while the deleveraging process takes time.

thereby will be possible to see Private Debt Distress in the Commercial Properties Market and wider Real Estate market, which has been feeding through the economy with economic output stagnation and unemployment, while this macro-economic framework could become a feature for the Swedish economy until the structural deleveraging process and Real Estate, Commercial and Housing Market Overvaluation Gaps are normalised with a continued process of discounting of the Commercial Properties and Housing market speculative asset Overvaluation.

Sweden’s equities market could be prone to a much deeper OMSX30 correction in equities prices with a possible scenario of -31.5% OMSX30 market correction down to OMSX30 1785.