Global equities performances and precious metal continue to the upside, while on the macro economic level, the global economy shows precious little, with slowing growth across the piece, peristent inflationary pressures and declining economic activities, in all major developed economies, not to mention France quagmire and inability to have a government and a fiscal budget, while public debt and deficit continue to increase. On the other side of the Atlantic, the United States has been going through the usual Government shutdown, also a clear sign of the inability of Governments and political classes to manage public expenditures with fiscal discipline and a balanced budget. On the horizon, institutional investors and Central Banks will have to grapple with the Q4 nonsensical last-minute bog job of Fiscal Budgets, beginning from the UK’s highly risky fiscal position with mounting liabilities of Inflation-Indexed-Linked-Gilts, while France continues stalling and it’s likely not to have any budget any sooner.

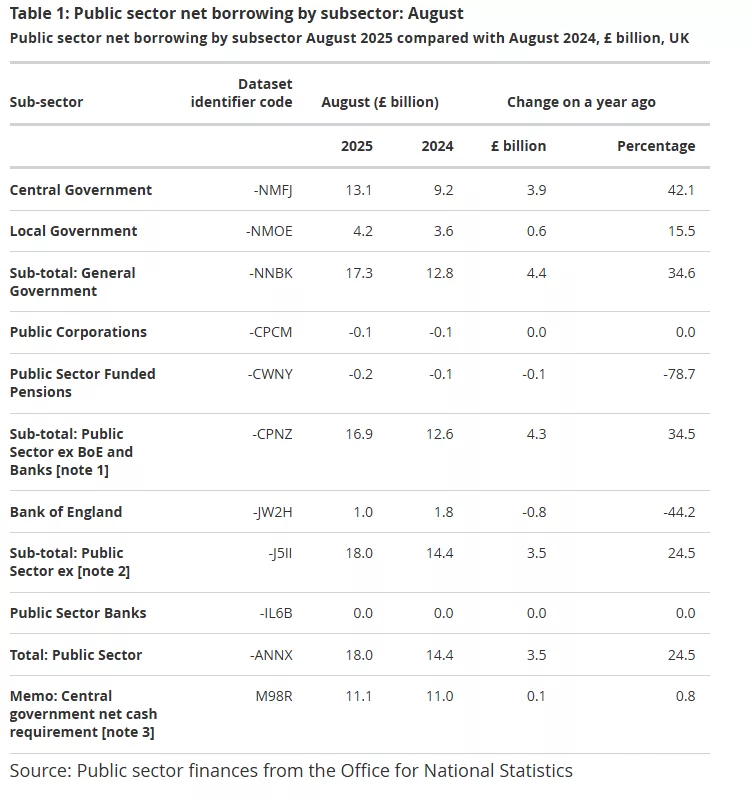

According to the latest ONS data in August 2025, the UK borrowing figures for the 2025 FY were of 83,3 billion.

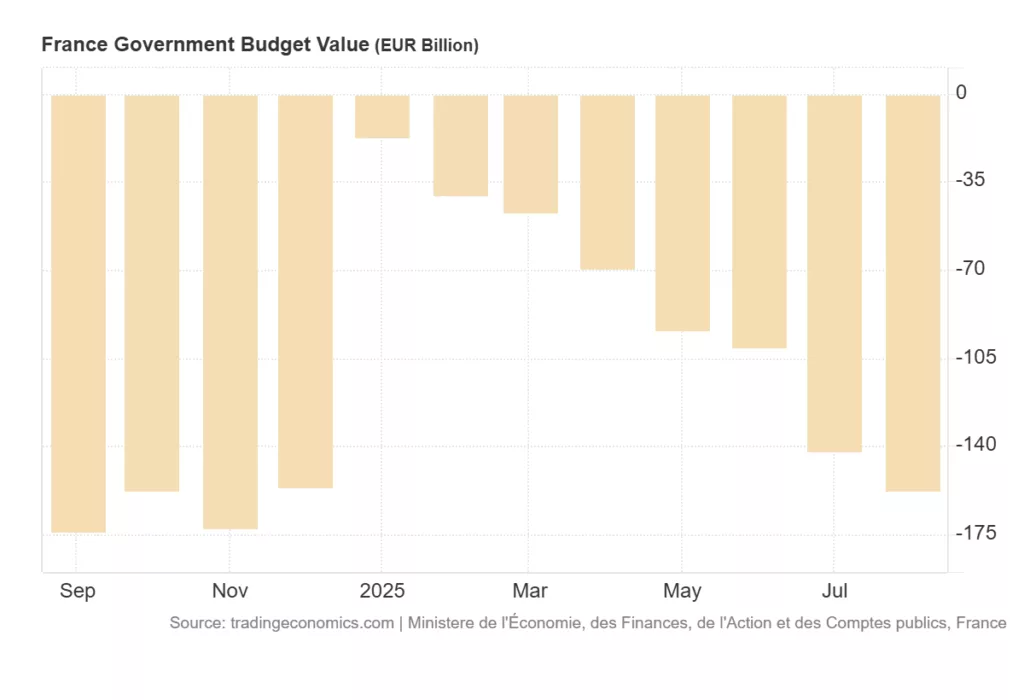

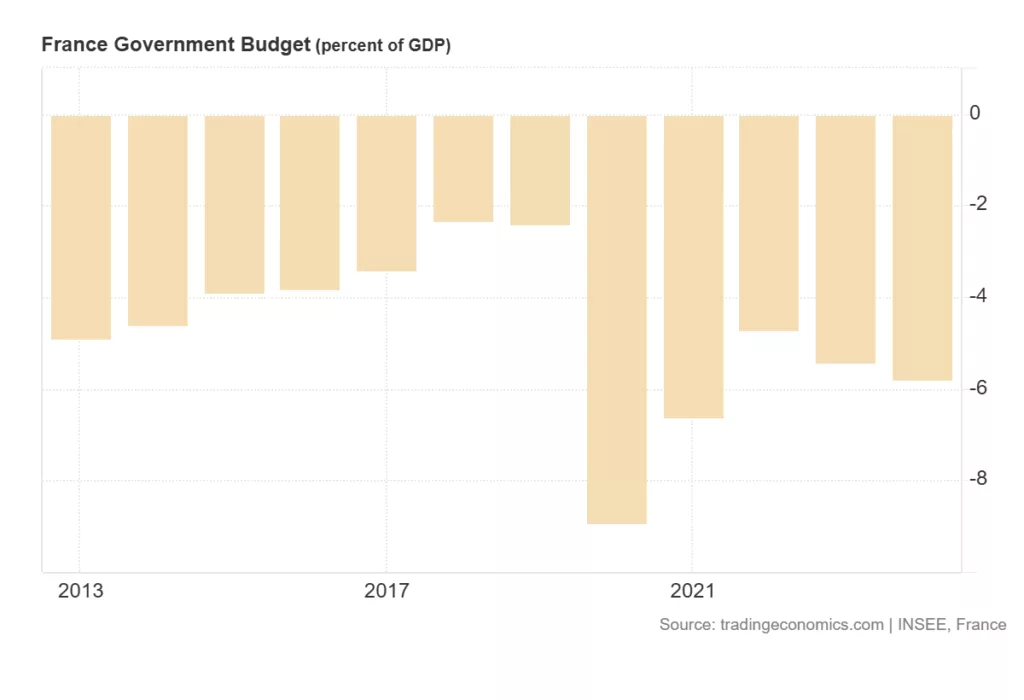

France Budget Deficit

France’s budget deficit has reached alarming proportions. In 2024, the deficit stood at 5.8% of GDP, representing approximately €168.6 billion. This figure, while slightly better than initially feared, is nearly double the 3% threshold mandated by EU fiscal rules. The situation has deteriorated steadily, rising from 5.5% in 2023 to what some estimates initially projected as 6.1% for 2024. The European Union took formal action against France in July 2024 for violating the bloc’s budgetary rules, placing the country under an excessive deficit procedure. France now holds the dubious distinction of having one of the highest deficits in the eurozone, alongside concerns about its public debt, which has climbed above 113% of GDP.

Also on the Italian front, the Government will start to face the shortfalls of the end of the European Recovery Fund bonus liquidity, without which Italy’s economy would not have shown any signs of economic growth. Withstanding European Recovery Fund, Next Generation EU massive multi-billion liquidity provided to the Italian Government, economic growth in the past three years has been pathetic and disappointing, Italy GDP Growth Rate prove anemic economic activity, while probably European Funds have ended up in the pockets of widespread political corruption, pumping up fake expenditures, bribes and the expansion of the public expenditure for additional useless unproductive political employees, aides and political pariahs.

Perhaps more troubling than the debt itself is Italy’s inability to grow its way out of the problem. For over two decades, Italy has recorded GDP growth rates that have been very subdued and disappointing. While other European economies have recovered and expanded since the 2008 financial crisis and the COVID-19 pandemic, Italy has limped along with growth rates often below 1% annually. The country’s productivity has stagnated, its labour market remains rigid, and its business environment continues to discourage both domestic investment and foreign capital. Young Italians increasingly seek opportunities abroad, creating a brain drain that further undermines long-term growth prospects.

The Fiscal Cliff Shenanigans and the Ineptitude of Politicians

From Washington to Rome, going through London and Paris, only one theme characterises the quagmire stagnating macro-economic frameworks across the Global Economies. The leitmotif is that of rats fighting in a sack for the crumbs of cheese of the few crumbles of Public Debt Borrowing inept politicians can scrape for their pockets and their pork-barrell politics and corruption. This leitmotif will soon come to an abrupt end when the screeching sounds of the A.I. bubble are going to pop. The Global Economy will inevitably sink into some sort of slowdown and recession, unveiling the veil of greediness, bad management, hypocrisy and dehumanising rhetoric. Still, for many millions and billions of global citizens, the question will not be that of money, as for those money-obsessed politicians and financiers speculators.

- UNITED STATES GOVERNMENT VIOLATIONS OF HABEAS CORPUS ARE A VIOLATION OF ARTICLE 3 OF THE NATO TREATY AND A THREAT TO INTERNATIONAL LAW

THE UNITED STATES OF AMERICA WILL BE OFFICIALLY DEFINED: ROGUE STATE IN THE FORM OF ETHNO-NATIONALIST, NAZIST, WHITE SUPREMATIST, GENOCIDAL TOTALITARIAN DICTATORSHIP. The UNITED STATES Government Has Been Acting Unlawfully In violation of Constitutional Civil Rights And International Law Treaties, not fulfilling its obligations to the Principles Of Article 3 Stated In The NATO TREATY… Read more: UNITED STATES GOVERNMENT VIOLATIONS OF HABEAS CORPUS ARE A VIOLATION OF ARTICLE 3 OF THE NATO TREATY AND A THREAT TO INTERNATIONAL LAW

THE UNITED STATES OF AMERICA WILL BE OFFICIALLY DEFINED: ROGUE STATE IN THE FORM OF ETHNO-NATIONALIST, NAZIST, WHITE SUPREMATIST, GENOCIDAL TOTALITARIAN DICTATORSHIP. The UNITED STATES Government Has Been Acting Unlawfully In violation of Constitutional Civil Rights And International Law Treaties, not fulfilling its obligations to the Principles Of Article 3 Stated In The NATO TREATY… Read more: UNITED STATES GOVERNMENT VIOLATIONS OF HABEAS CORPUS ARE A VIOLATION OF ARTICLE 3 OF THE NATO TREATY AND A THREAT TO INTERNATIONAL LAW - The Necessity of a United Nations HQ Relocation to the Hague with a Permanent Nuremberg Tribunal.The Impunity Crisis of Rogue Governments

The world witnesses today an unprecedented crisis of accountability in international law. As the genocide in Gaza unfolds before global eyes, as war crimes multiply across Ukraine, Myanmar, and countless other conflicts, the United Nations stands paralysed, not by lack of legal framework, but by institutional capture that protects the very criminals it should prosecute.… Read more: The Necessity of a United Nations HQ Relocation to the Hague with a Permanent Nuremberg Tribunal.The Impunity Crisis of Rogue Governments

The world witnesses today an unprecedented crisis of accountability in international law. As the genocide in Gaza unfolds before global eyes, as war crimes multiply across Ukraine, Myanmar, and countless other conflicts, the United Nations stands paralysed, not by lack of legal framework, but by institutional capture that protects the very criminals it should prosecute.… Read more: The Necessity of a United Nations HQ Relocation to the Hague with a Permanent Nuremberg Tribunal.The Impunity Crisis of Rogue Governments - THE UNITED STATES VICE-PRESIDENT IS EXPRESSION OF THE DERANGED INNER CIRCLE OF AMERICAN-NAZIST RUNNING THE WHITE-NUTHOUSE

By the time the cameras cut away, the Vice-President had spoken for exactly 2,040 seconds.That was all it took to show the country what psychiatrists, threat-assessment experts and even some of his former college classmates have quietly warned for years: JD Vance is not merely partisan; he is psychologically unfit to wield power. Here’s provided… Read more: THE UNITED STATES VICE-PRESIDENT IS EXPRESSION OF THE DERANGED INNER CIRCLE OF AMERICAN-NAZIST RUNNING THE WHITE-NUTHOUSE

By the time the cameras cut away, the Vice-President had spoken for exactly 2,040 seconds.That was all it took to show the country what psychiatrists, threat-assessment experts and even some of his former college classmates have quietly warned for years: JD Vance is not merely partisan; he is psychologically unfit to wield power. Here’s provided… Read more: THE UNITED STATES VICE-PRESIDENT IS EXPRESSION OF THE DERANGED INNER CIRCLE OF AMERICAN-NAZIST RUNNING THE WHITE-NUTHOUSE - The Digital Job Posting Bubble: Quantifying Phantom Demand in Online Labor Markets

Are businesses and corporates truly hiring ? Has the digital economy become a massive convenience mystification of actual economic activities? How large, systemic and unstable is the assets bubble built by Wall Street financial engineering and gambling addiction? What are the empirical evidence of structural distortions in digital labor markets that represent a significant and… Read more: The Digital Job Posting Bubble: Quantifying Phantom Demand in Online Labor Markets

Are businesses and corporates truly hiring ? Has the digital economy become a massive convenience mystification of actual economic activities? How large, systemic and unstable is the assets bubble built by Wall Street financial engineering and gambling addiction? What are the empirical evidence of structural distortions in digital labor markets that represent a significant and… Read more: The Digital Job Posting Bubble: Quantifying Phantom Demand in Online Labor Markets - The U.S. NSS 2025 is a Grandiose Magalomaniac view of the WorldThe 2025 U.S. National Security Strategy is the first state paper to be issued from inside a full-blown collective state apparatus psychosis. It does not calibrate means and ends within an external geopolitical field; instead, it externalises an internal grandiose magalomaniac oniric dream of the United States onto which a wounded super-ego projects its wish-fulfilments.… Read more: The U.S. NSS 2025 is a Grandiose Magalomaniac view of the World