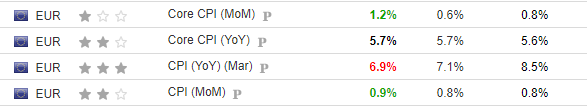

Euro Area Inflation data are quite controversial. CORE CPI jumps to 1.2% an increase of 0.4% from the previous month, therefore CPI CORE INFLATION year on year needs to be 6.0%, not 5.7%. 0.9% CPI Inflation increased +0.1% from the previous month, CPI year on year 8.6%, not 6.9%.

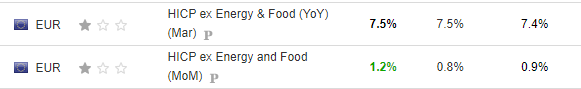

Data becomes even more controversial when observing HICP Excluding Food & Energy, 1.2% increased +0.3% from the previous month and 7.5% year on year.

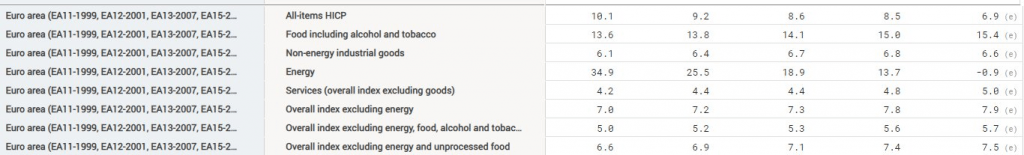

the volatility of the Euro Area Inflation Data can be ascribed to the consistent decrease in energy prices. In fact, the HICP % change on a yearly basis went from Feb,13.7% to March -0.9%. All other broad components of the Inflation basket, such as food, services(excluding goods), industrial goods excluding energy. A 2Y estimate of Euro Area inflation expectations could be 4.8%, the estimate of 5y HICP Inflation expectations, ILS, should be 4.6%, for the Euro Area. Euro Area interest rates could have to be raised to 4.0% | 4.25%.

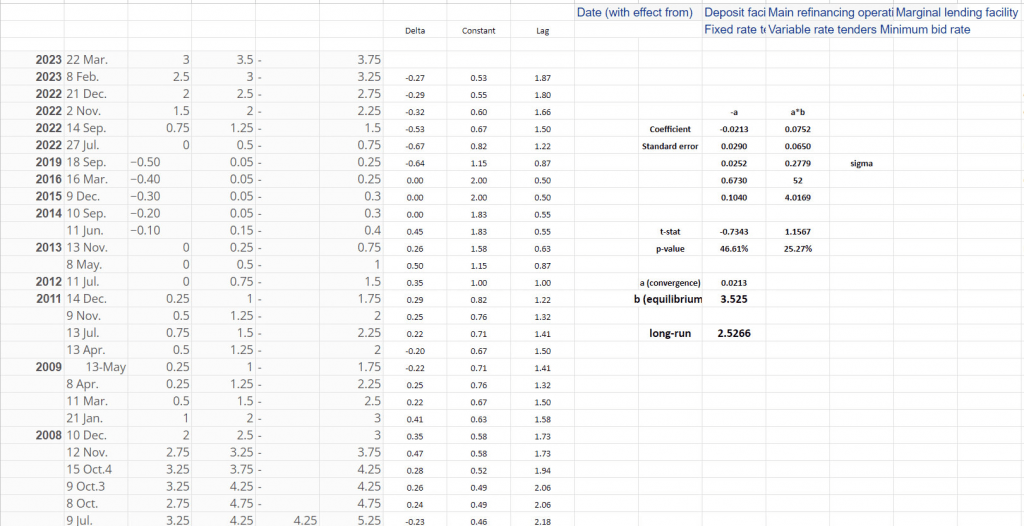

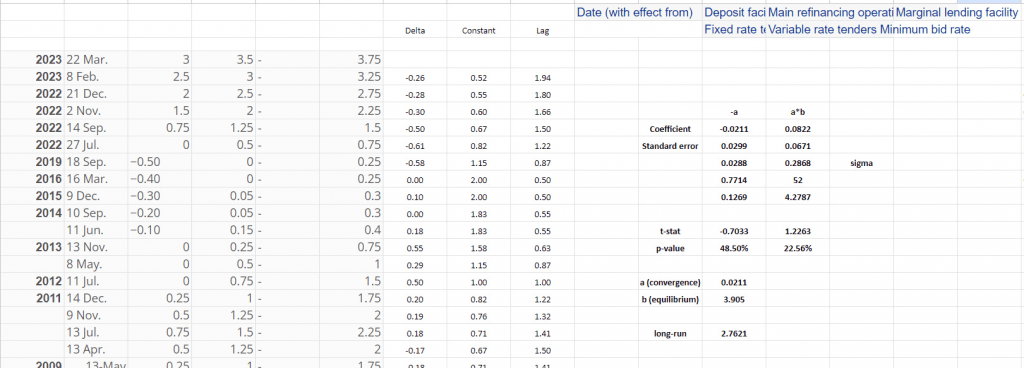

Euro Area Marginal Lending Facility, Ingersoll model forecast

Equilibrium Interest Rate 3.9%

Long Run Interest Rate 2.75%

Euro Area Main Refinancing interest rate forecast, Ingersoll model,

Equilibrium Interest rate 3.55%

Long Run Interest rate 2.55%