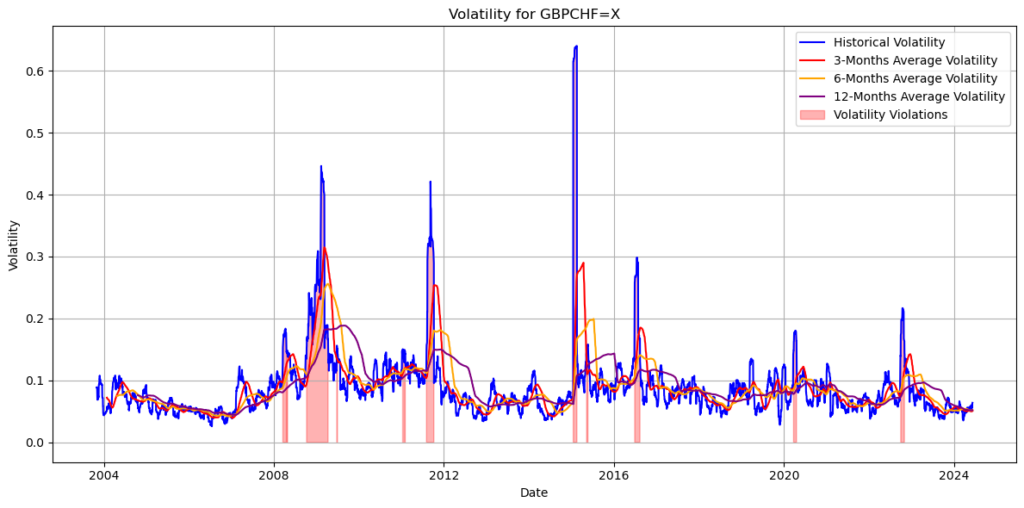

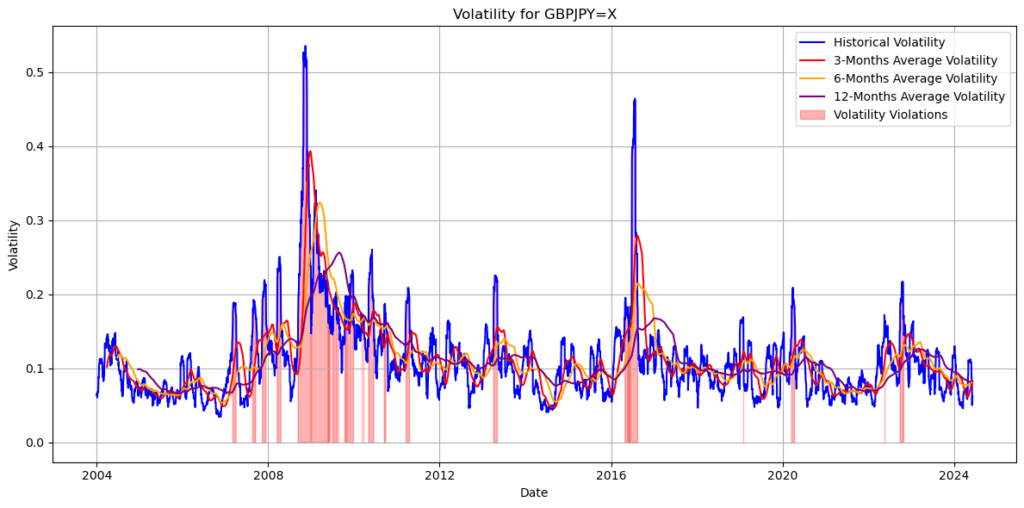

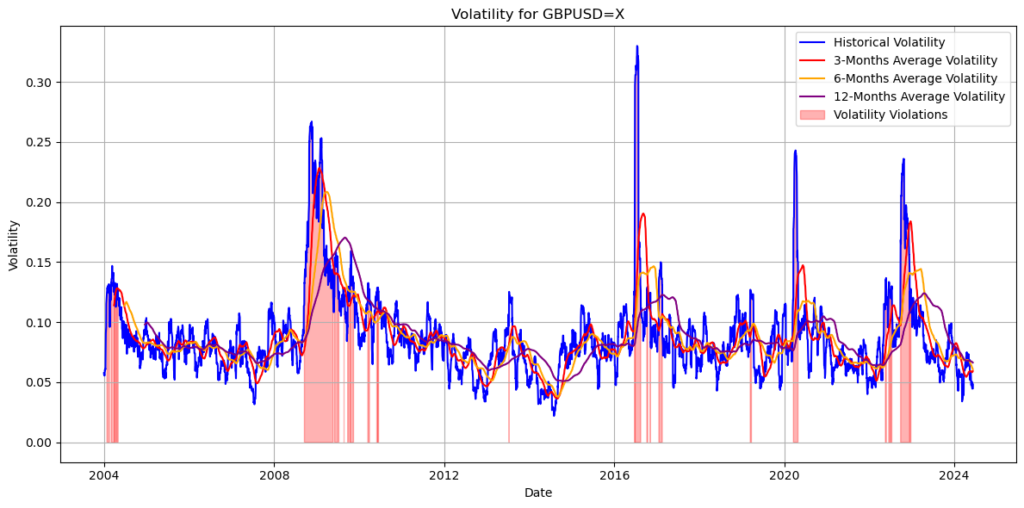

GBP/CHF, GBP/JPY AND GBP/USD GRAPHS OF HISTORICAL VOLATILITY CALCULATED WITH 30 DAYS STDV OF LOG RETURNS, THEN 3-MONTH, 6-MONTH AND 12-MONTH AVERAGE VOLATILITY. THE GRAPHS OF GBP/CHF, GBP/JPY AND GBP/USD SEE THE 3-MONTH AVERAGE VOLATILITY LINE DRIFTING UPWARD TO CROSS ABOVE THE 6-MONTHS AND 12-MONTHS AVERAGE VOLATILITY, IN PREVIOUS OCCASION THE 3-MONTH VOLATILITY MOVING AVERAGE DRIFT HAS THEN IMPLIED VOLATILITY VIOLATION OCCURRENCE, HENCE POUND STERLING MONEY MARKET VOLATILITY AND PROBABLE POUND STERLING SELL OFF. IN THIS CASE, VOLATILITY RISING RISKS GOING TO SAFE HEAVENS CURRENCIES AS (SWISS FRANC) GBP/CHF, (JAPANESE YEN) GBP/JPY AND (USDOLLAR) GBP/USD. FX MARKETS VOLATILITY AND FLOWS INTO SAFER CURRENCIES, WOULD IMPLY STOCK MARKET VOLATILITY AS WELL, TO CONSIDER THE UPCOMING UK NATIONAL GENERAL ELECTION AS VOLATILITY POINT, FOR POUND STERLING DEPRECIATION GOING INTO 2025, LINKED TO A POSSIBLE STOCK MARKET CORRECTION.